Market Commentaries

Seeking Higher Ground

Is May the month stocks regain their footing? Dive into this week’s commentary as we analyze the market’s performance after a weak April and discuss our outlook moving forward.

All-Time Heater

The U.S. stock market is coming off an all-time heater, gaining more than 25% in 5 months. Does history have anything to say about what comes next for stocks? Check out this week’s commentary for answers.

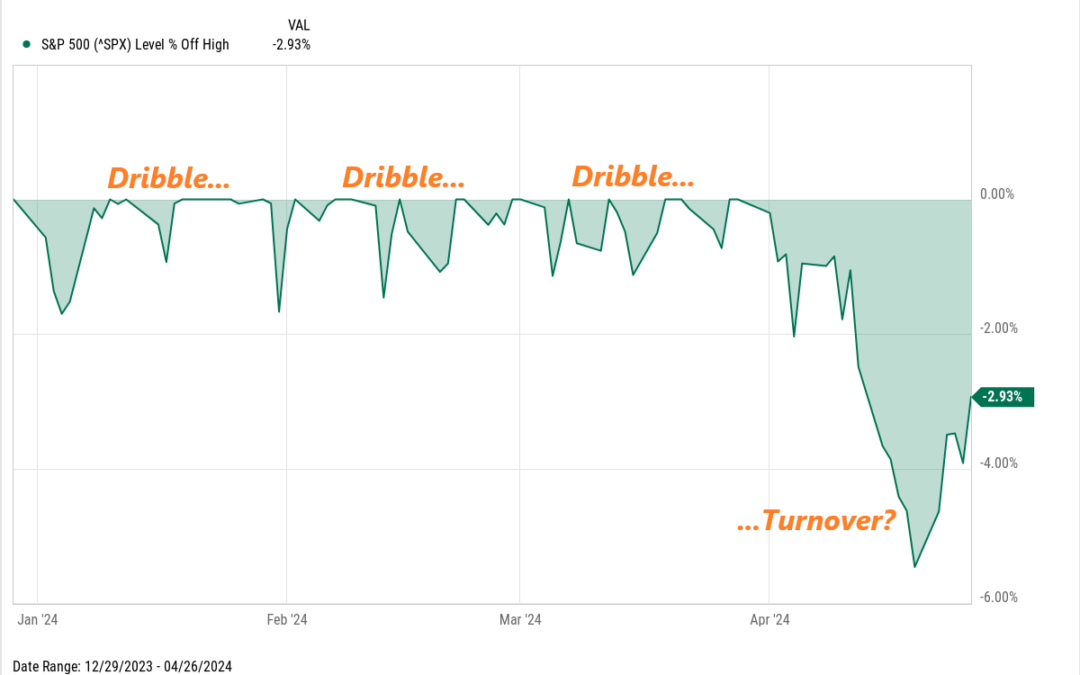

Regaining Possession

The stock market looked like a basketball player calmly dribbling down the court until it lost control of the ball about a month ago. After last week’s rally, however, it’s got us wondering: Has the market regained possession? Check out this week’s commentary for our take.

A Dangerous Leap

Managing risk is a matter of life and death for a daredevil like Evel Knievel. While investing might not be as heart-stopping, managing risk is just as crucial. Check out this week’s commentary to learn more about how risk management is vital to investing.

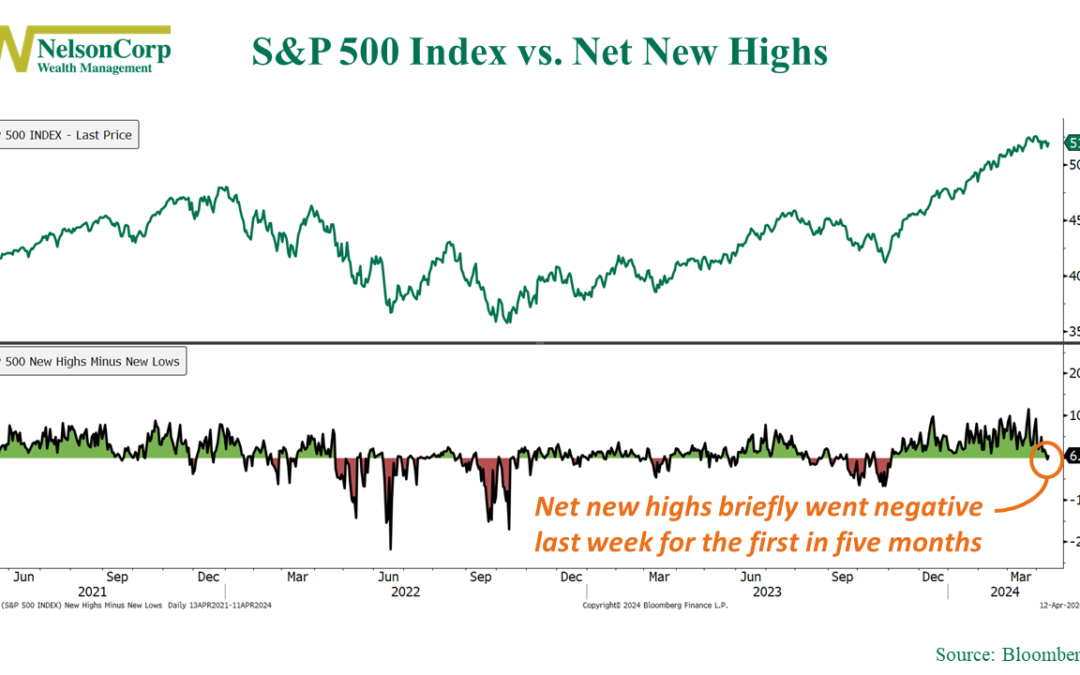

Bull Market Checklist

Should you be worried about the stock market’s recent weakness? Check out this week’s commentary, where we go through our “bull market checklist” for answers.

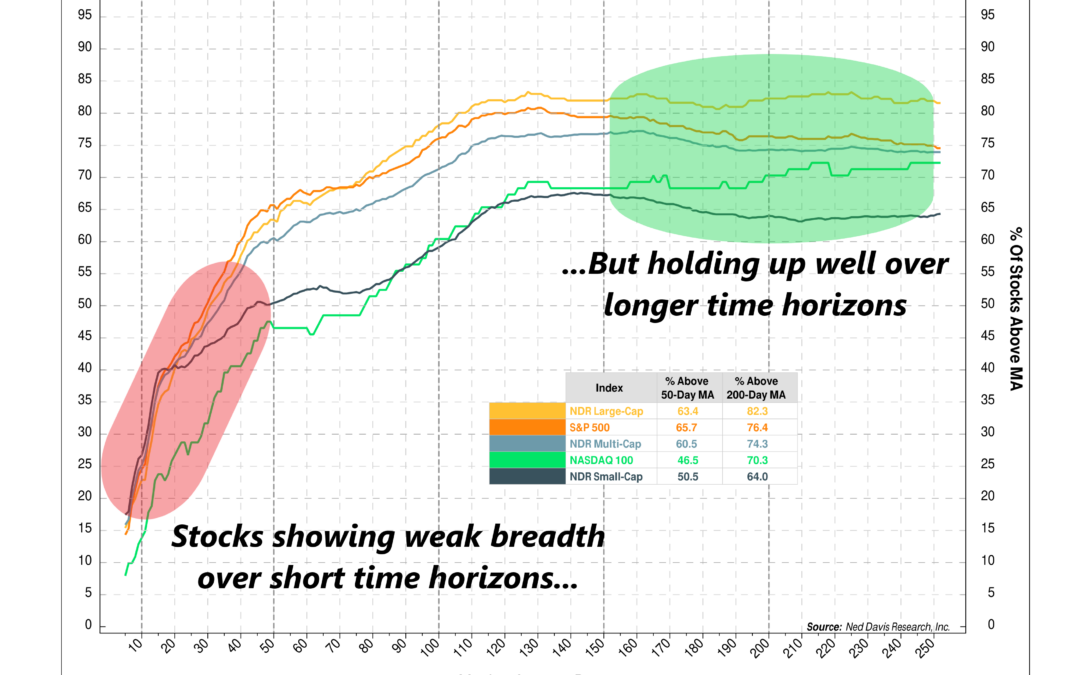

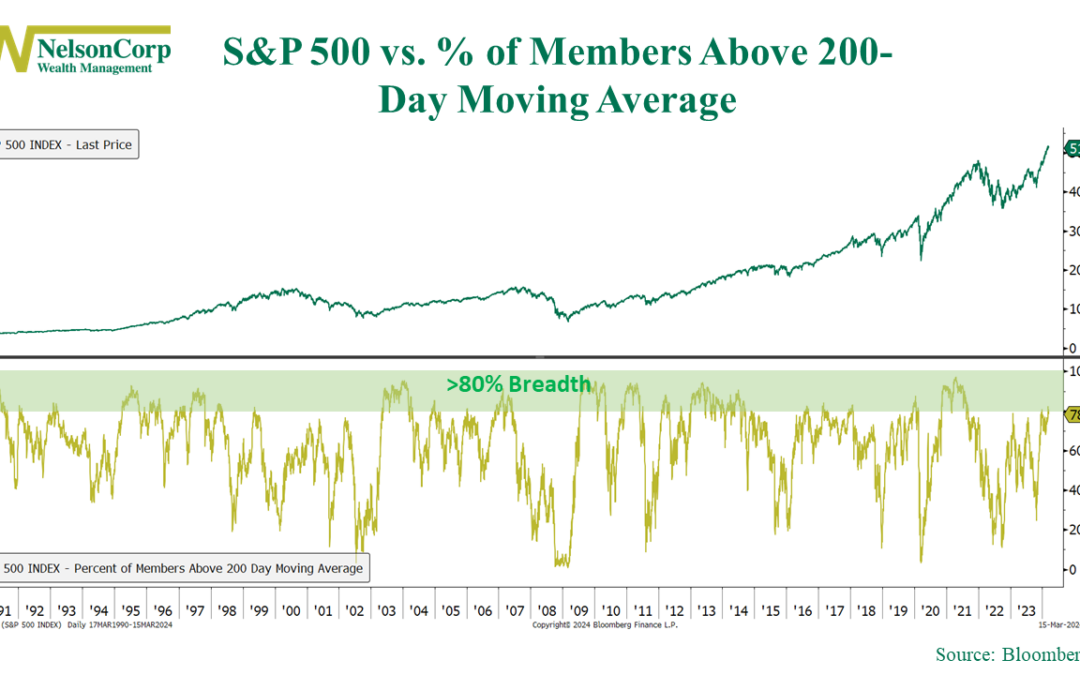

Riding the Bull

Is the bull market trying to throw off some riders? In this week’s commentary, we look at a chart illustrating breadth across different time horizons to uncover some clues.

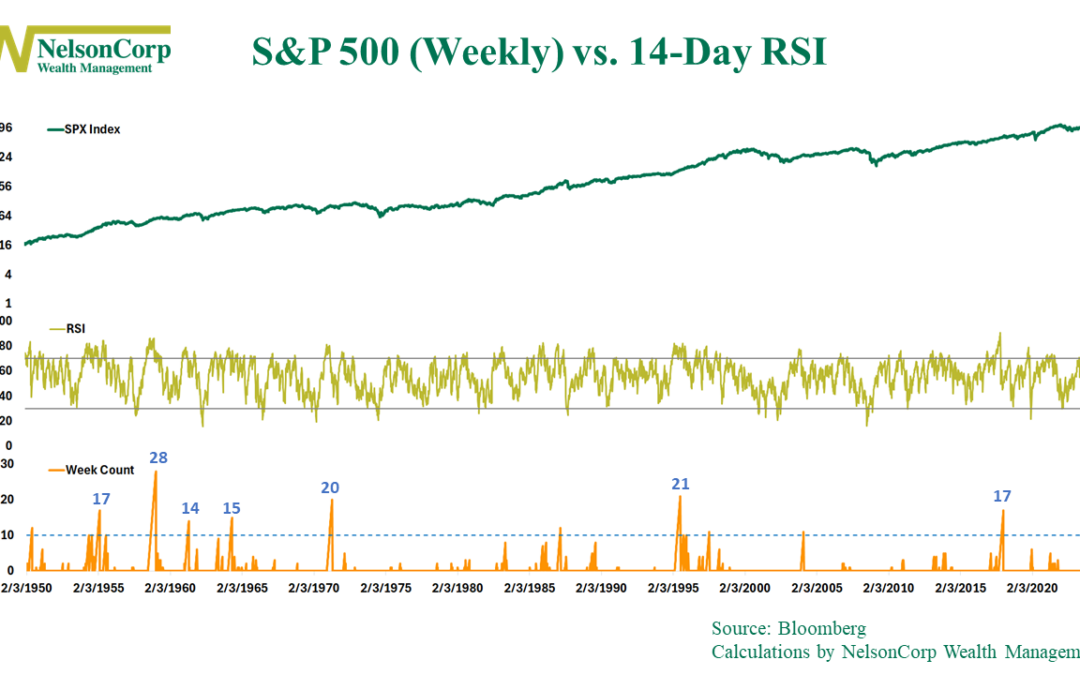

Going Yard

An important technical indicator is warning that stocks are in danger of being overbought. In this week’s commentary, we discuss the implications of the market’s recent strong momentum and highlight what a low equity risk premium means for stocks and bonds going forward.

Hot Start

The S&P 500 stock index has been on fire to start the year, reaching 20 record highs already. In this week’s commentary, we look at the historical record to answer the question: have stocks gone up too fast?

A Breadth of Fresh Air

In this week’s commentary, we discuss the recent expansion in stock market breadth and what it means for the market’s long-term health.

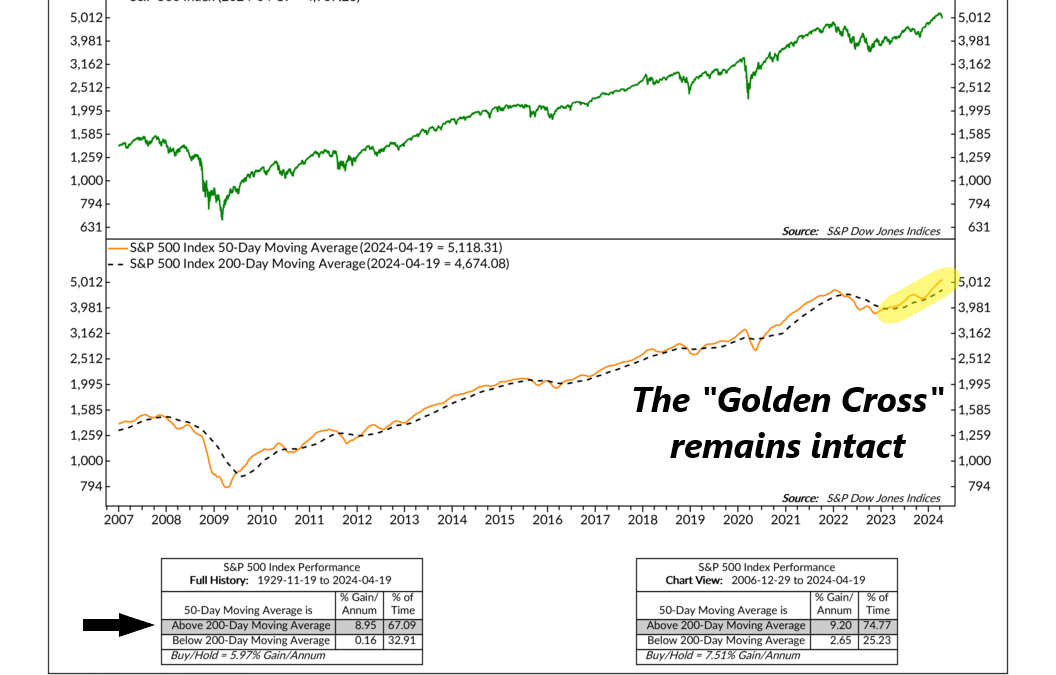

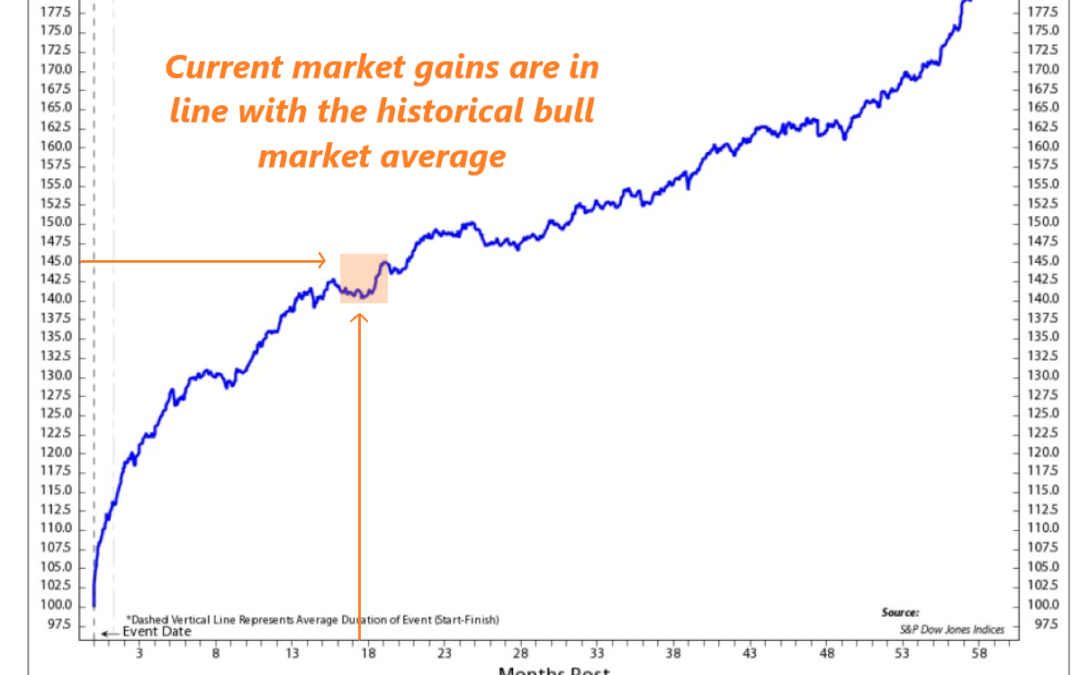

It’s Good to Be Average

They say you shouldn’t settle for average. But when it comes to bull markets, we say differently. Check out our latest weekly market commentary to find out why.

Simplify your financial life today, contact CMR Financial Advisors to get started.

CMR Financial Advisors, Inc.

1003 Bishop Street, Suite 2620

Honolulu, Hawaii 96813

808-537-2912

Email Us