OVERVIEW

Last week was a good one for U.S. stocks, with the Dow up 1.97%, the S&P 500 rising 2.29%, and the Nasdaq surging 2.85%. Small-cap stocks lagged slightly, up about 1.3% for the week.

Foreign stocks also saw gains, with developed country stocks rising 1.14% and emerging markets gaining 0.44%.

The 10-year Treasury yield dropped to 4.2%, resulting in higher Treasury bond prices. Overall, the bond market saw a rise of about 0.74%.

Real assets, on the other hand, faced some challenges. Real estate dropped 0.73%, and commodities broadly dipped 0.5%.

Additionally, the U.S. dollar strengthened by about 1.2%.

KEY CONSIDERATIONS

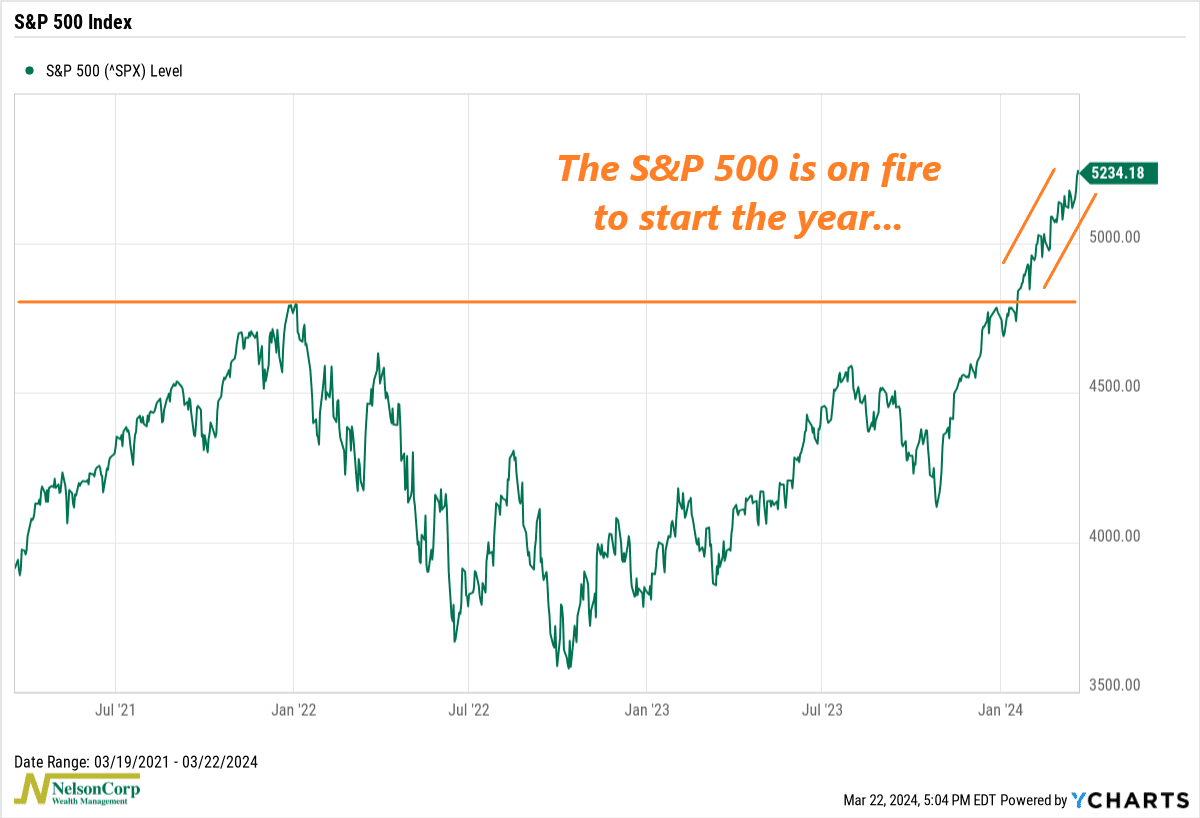

Hot Start– March Madness is here! But it’s not just college basketball players making waves with their hot hands and buzzer-beating shots. The U.S. stock market is making a run of its own, increasing at a blistering pace to start the year.

Ever since the S&P 500 Index hit a new all-time high earlier this year, it has sprung higher like a jack-in-the-box.

Should we be worried about how quickly the market has risen?

The answer, according to history, is not really. But there’s some nuance. Here’s why:

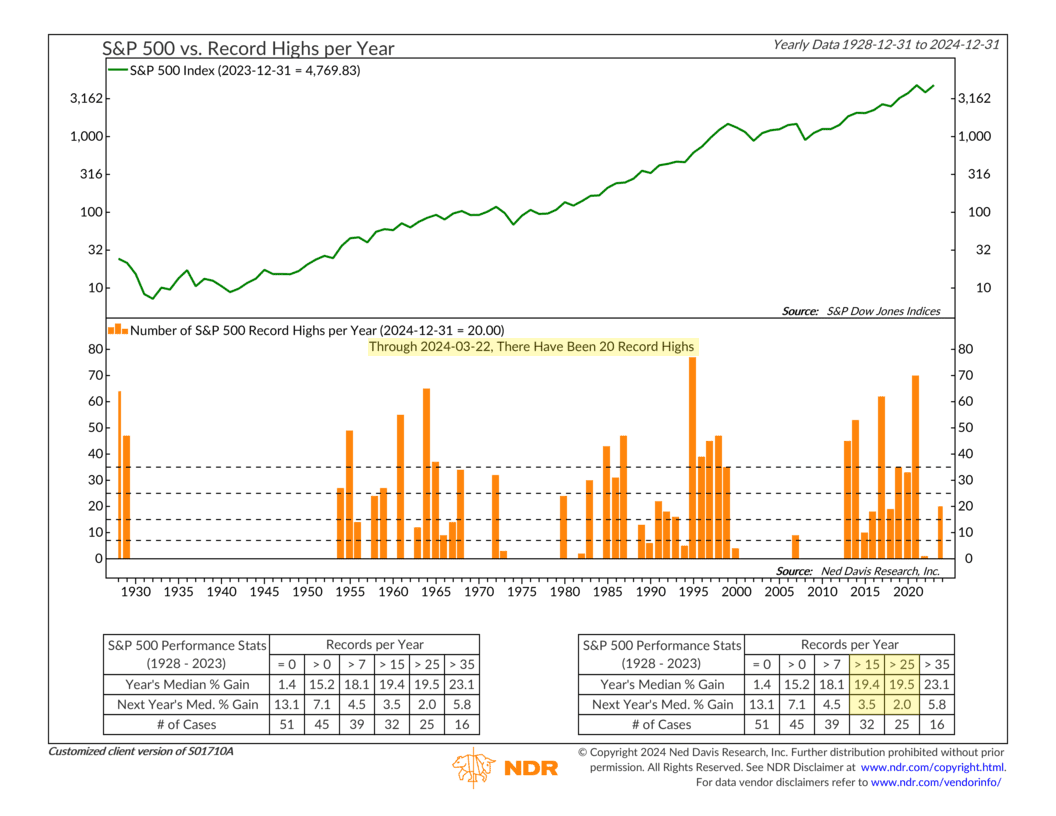

This next chart shows the number of record highs the S&P 500 has hit per year, going back to 1928. The performance box at the bottom also shows how the index tends to perform during various new-high scenarios.

As you can see, we’ve already reached 20 record highs this year. According to the performance box, when there have been at least that many record highs in a year, the S&P 500 has gained about 20%, on average, that year. So that’s the good news.

The less great news, however, is that the following year’s average gain drops significantly when we’ve had this many record highs in a year, to somewhere between 2% and 6%, on average. That’s not terrible—but it’s not great, either.

So, what’s the takeaway? This is a good reminder that we can enjoy the gains and ride the wave when the market has a hot hand, but also be prepared for any potential slowdown in the future. It’s important to know what you own and have a plan in place ahead of time for your investments.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The Nasdaq 100 Index is a basket of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks.

The post Hot Start first appeared on NelsonCorp.com.