Wealth with Simplicity®

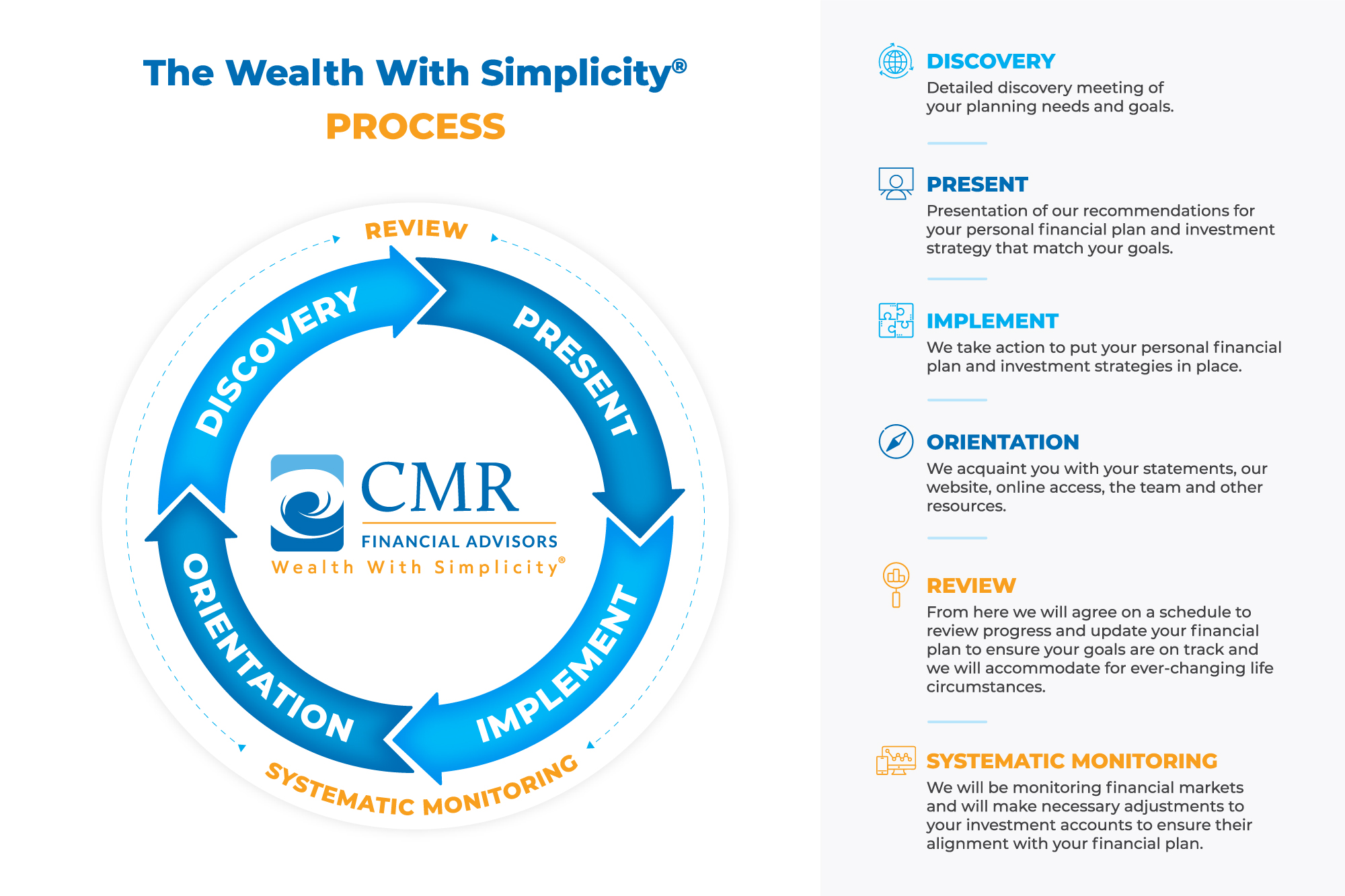

You will have a number of important financial goals across your lifetime – from mitigating taxes to saving for your retirement. Do you know how to manage each of these goals? Our process focuses on taking a comprehensive look at your financial goals and needs. Together, we will simplify the steps you need to take to work toward your financial dreams. We will be with you the entire way, as your coach and your advisor.

Simplify your financial life today, contact CMR Financial Advisors to get started.

CMR Financial Advisors, Inc.

1003 Bishop Street, Suite 2620

Honolulu, Hawaii 96813

808-537-2912

Email Us

Copyright © 2024

CMR Financial Advisor, Inc.