OVERVIEW

U.S. stocks showed their resiliency last week, posting their biggest weekly gain in three months.

The S&P 500 rose 3.84 percent, the Dow climbed 3.27 percent, and the Nasdaq gained a monster 4.56 percent.

International stocks did similarly well. Developed country stocks rose 2.23 percent, and emerging market stocks gained 3.3 percent.

In bond markets, the yield on 10-year U.S. Treasury notes ticked up to 0.77 percent from 0.69 percent the week before. Treasury prices fell as a result, but corporate bonds did well.

Commodities had a good week, rising well over three percent, on average. Oil bounced nearly nine percent, and corn prices rose about four percent. Gold was up about one percent.

The U.S. dollar weakened by about 0.9 percent for the week.

KEY CONSIDERATIONS

Stock Parry and Thrust…but Buyer Beware – The selling pressure that plagued stocks in September eased substantially last week.

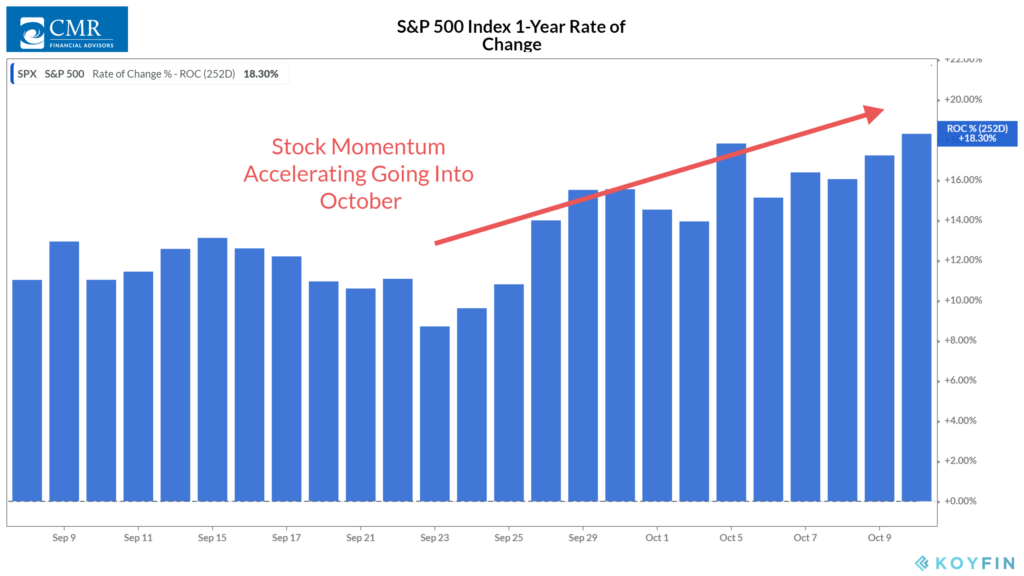

For starters, stock returns picked-up on a 252-day (1-year) basis relative to more recent returns. This wiped out the negative momentum signal we received in September, a sign of a more neutral trading environment.

We also saw the percentage of stocks closing above their average 200-day price climb to 73 percent. Historically, the S&P 500 stock index has averaged returns of close to 11 percent per annum when this is the case.

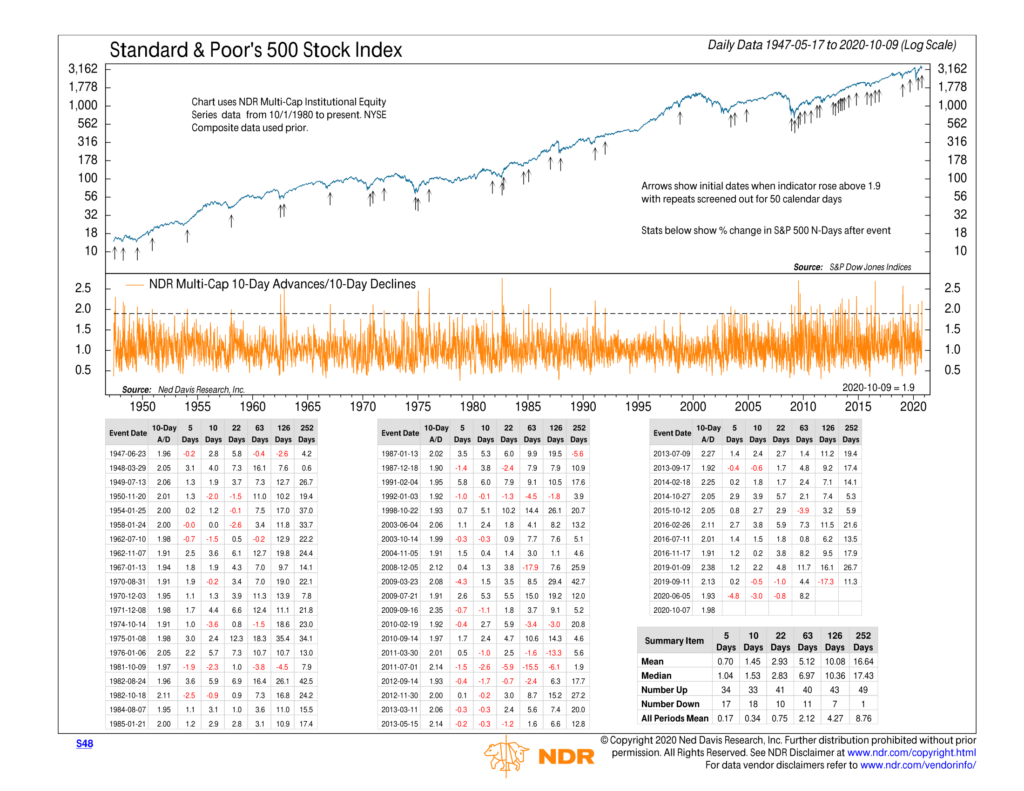

However, the big guns came out with the legion of breadth thrusts that occurred last week.

A breadth thrust is just another way of measuring market momentum. When the proportion of stocks increasing in price relative to the ones declining becomes large enough, and it happens in a short enough time frame, it triggers a breadth thrust. Stocks can go up aggressively after this happens.

Last week, the number of advancing stocks on a 10-day basis outstripped the number of declining stocks by a ratio of more than 1.9.

This last happened in June. Three months later, stocks returned about eight percent. On average, stocks gain about seven percent after this signal.

Breadth thrusts are powerful signs that stocks are in a bullish environment until proven otherwise.

However, there are reasons to be cautious at this juncture.

We see evidence from surveys and polling data that sentiment is once again rising to excessively optimistic levels. Stocks can struggle when the mob becomes too one-sided.

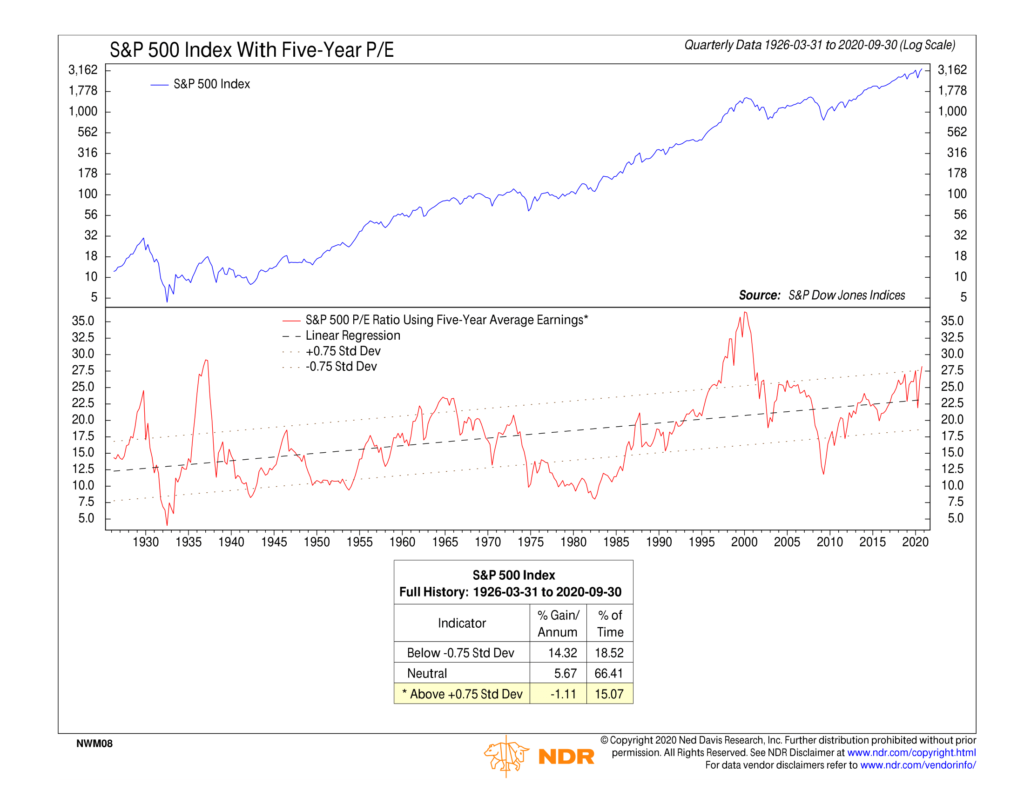

Valuations are also looking excessive. We like to look at the S&P 500 stock index’s P/E (price-to-earnings) ratio using the average of the past five years of earnings. We also apply a linear regression line with standard deviation brackets (whew, that was a mouthful!) to determine when prices are too high relative to what companies are earning.

After this most recent quarterly update, the P/E ratio popped above its upper standard deviation bracket, a sign of overvaluation. This should be in the back of investors’ minds going forward, as valuations are important drivers of long-term stock returns.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Stocks Parry and Thrust…but Buyer Beware first appeared on NelsonCorp.com.