OVERVIEW

The major U.S. stock indices failed to maintain last week’s positive momentum as the S&P 500 and the NASDAQ slipped around 1%, and the Dow fell nearly 2%. The S&P 600 index of small-cap stocks also dropped about 1.4%.

Most of the declines came on Thursday amid concerns surrounding the prospects of tighter monetary policy. Wednesday’s release of the minutes from the Fed’s mid-June meeting reinforced expectations that we will likely see further interest rate increases this year.

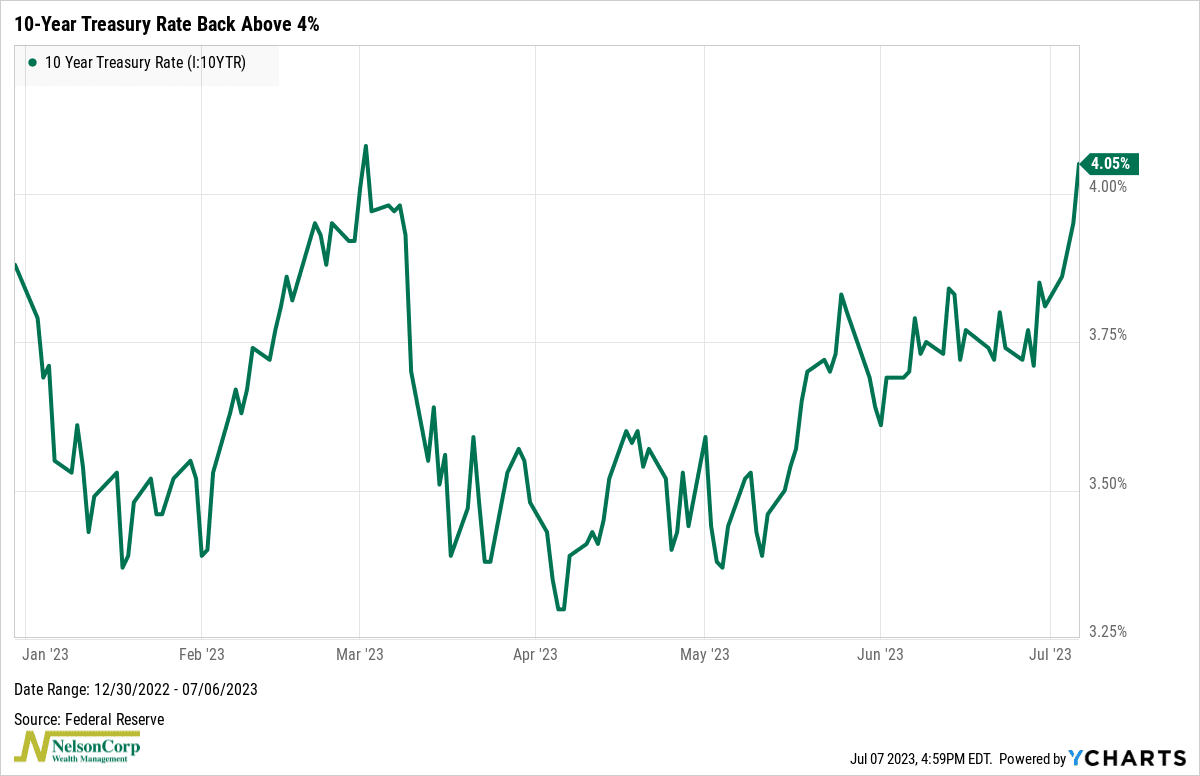

This sent yields of U.S. government bonds higher for a second straight week. The yield on the 10-year Treasury note rose to 4.05%, its highest level in four months. The 2-year note also briefly eclipsed 5% on Thursday before settling below that level by Friday. Overall, bond prices were down for the week.

Oil rose for a second consecutive week on the back of supply cuts from some major oil-producing countries. U.S. crude traded around $74 per barrel on Friday, up roughly 4% for the week. Gold rose about 0.16%, and corn traded lower by about 0.3%, resulting in an overall gain of approximately 0.4% for the Bloomberg Commodity Index. The U.S. dollar weakened about 0.5%.

In the week ahead, we’ll get the June release of the Consumer Price Index on Wednesday, which will tell us whether the recent slowdown in inflation continued last month. The prior release showed that while headline inflation rose at an annualized rate of 4% in May, core inflation was a bit higher at 5.3%.

KEY CONSIDERATIONS

Keeping an Eye on Rates – The bond market made some moves last week. The yield on the 10-year Treasury note rose above 4%, essentially matching its high for the year.

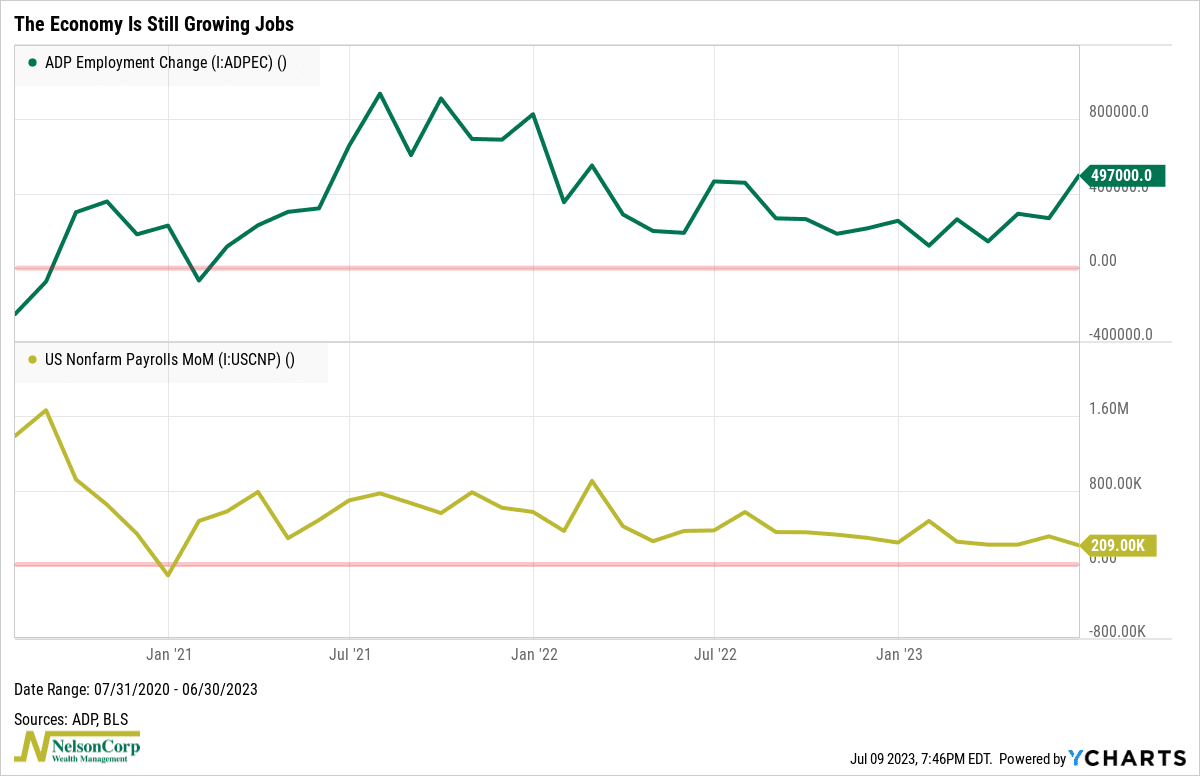

The catalyst? The ADP jobs report came out, and it was scorching hot, revealing that the private sector added nearly half a million jobs in June. The BLS jobs number, although weaker than expected, still showed decent job growth gains of over 200,000 for the month.

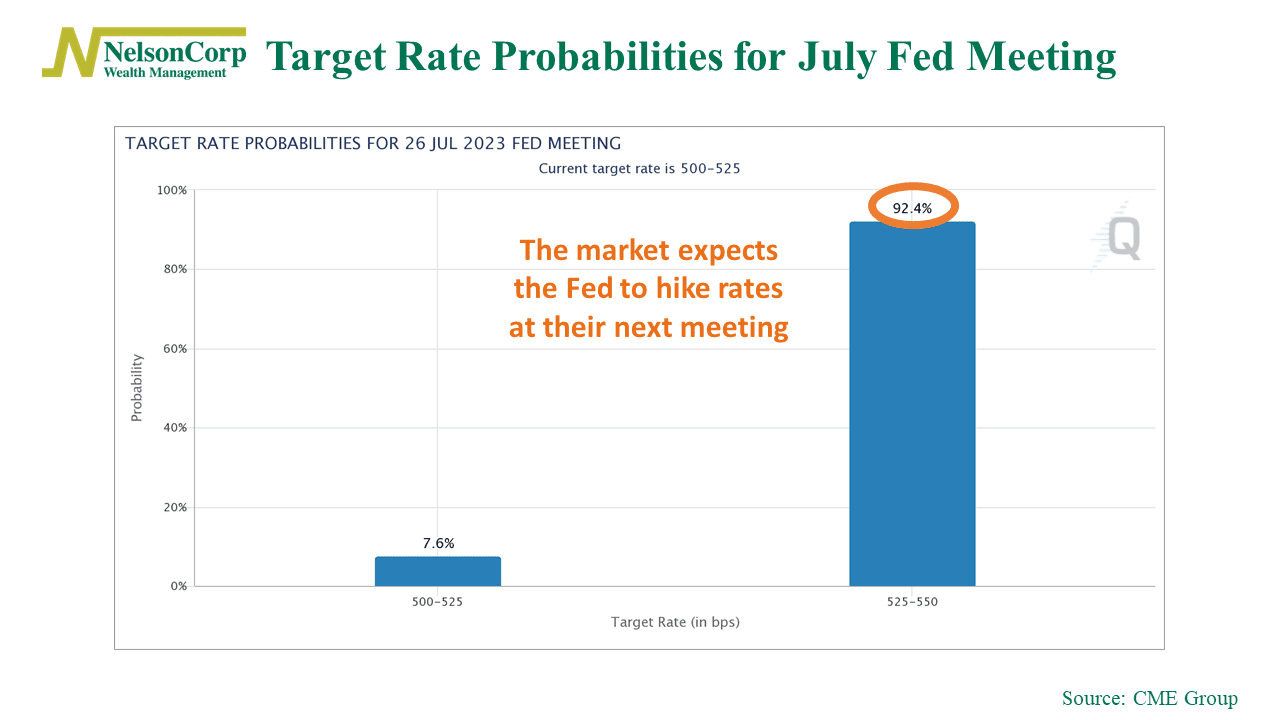

In other words, the economy—particularly the labor market—looks strong enough to absorb another Fed rate hike in September. According to the CME’s FedWatch tool, the odds of another hike on July 26th is about 93%, up from just 50% a month ago.

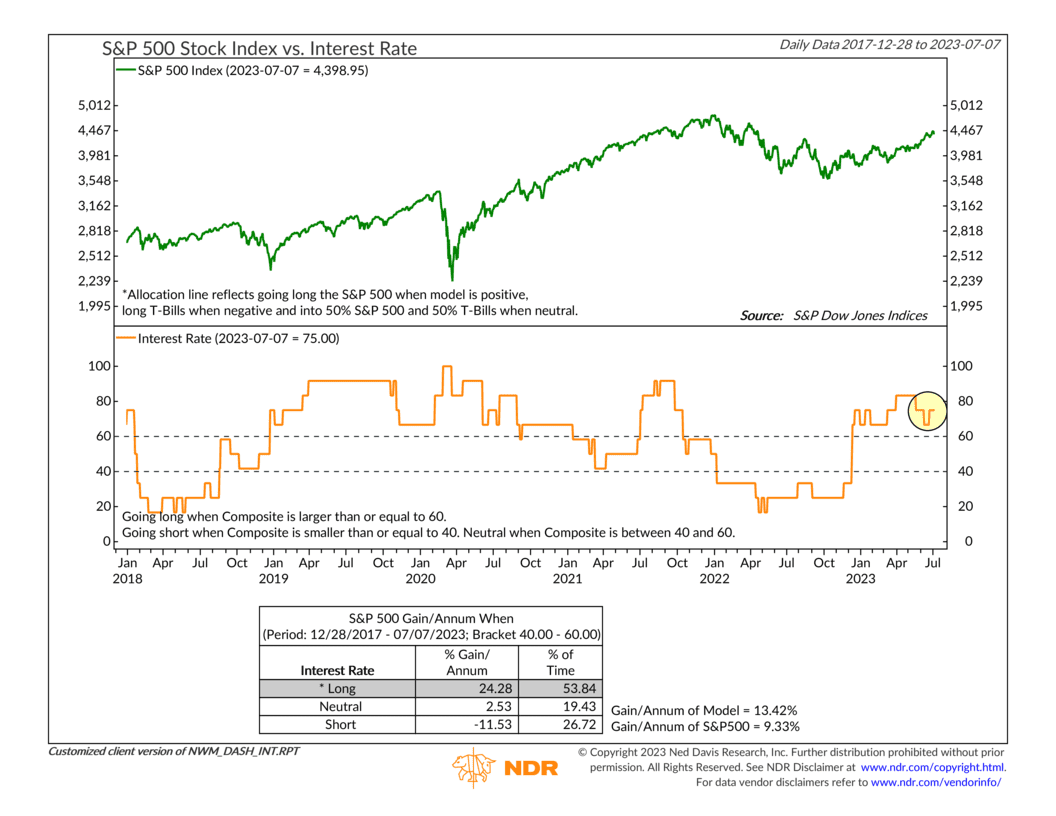

But the question is: are rising interest rates going to stall the rally in the stock market?

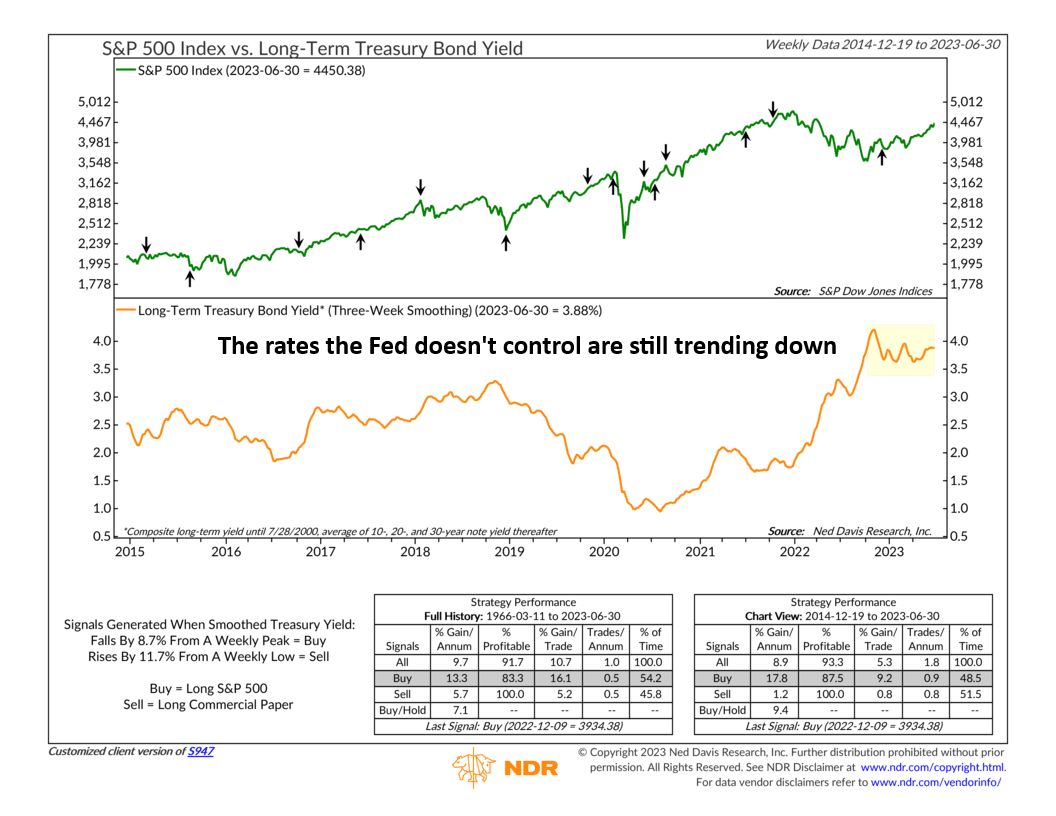

To answer that, a great place to start is our Interest Rate model, shown below. It’s a composite of six different interest rate indicators that help us measure how changes in interest rates have historically affected the stock market.

The good news is that, at least for right now, the current environment is bullish for stocks. Much of this has to do with the fact that longer-term rates—the rates the Fed doesn’t explicitly control—are still trending to the downside.

For example, the following chart shows the 3-week average yield of long-term Treasury bonds. As you can see, the measure peaked in November 2021 and triggered a “buy” signal for stocks in December. The S&P 500 has rallied nicely ever since.

For a negative signal to form, the 3-week average will need to rise by 11.7% from the weekly low set in April 2023. Essentially, we would need to see long-term bond yields average more than 4.05% for three weeks before this indicator goes negative.

That’s not necessarily out of the realm of possibilities. But it’s still too early to tell if the recent rise in rates will hold, so this will be a key measure to keep an eye on in the coming weeks.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly. The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The Nasdaq 100 index is a basket of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks.

Past performance does not guarantee future results.

The post Keeping an Eye on Rates first appeared on NelsonCorp.com.