OVERVIEW

The U.S. stock market resumed its selloff last week after pausing the week before. The S&P 500 fell 1.82%, the Dow dropped 1%, and the Nasdaq declined 2.18%.

Growth shares led the selling, falling 2.39%, whereas value stocks fell around 0.34%. A bright spot, however, was small-cap stocks, which rose around 1.37% for the week.

International stock markets did better than U.S. markets last week. Developed country stocks rose 1.41%, and emerging markets gained 1.59%.

Bonds deteriorated, however, as the yield on the 10-year Treasury note briefly rose about 2% before settling around 1.94% to end the week. Long-term Treasuries fell 0.74%, investment-grade bonds dropped 0.4%, high-yield bonds were down 0.96%, and municipal bonds fell 0.79%. TIPS, on the other hand, rose 0.11%.

Real assets held up better, as commodities rose about 0.3%, on average. Oil rose 1.28%, gold climbed 1.9%, and corn gained around 4.8%. Real estate, however, dropped about 1.67% for the week. And the U.S. dollar strengthened by about 0.67%.

KEY CONSIDERATIONS

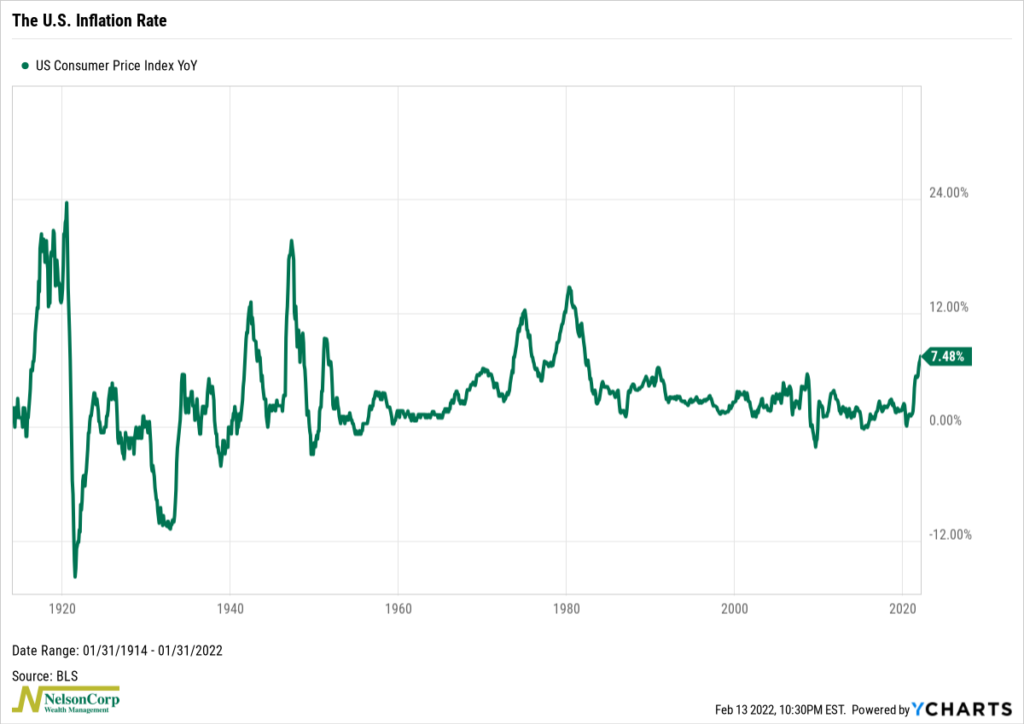

Inflation Blues – Inflation is sizzling hot in the U.S. right now, and it’s got investors singing the blues.

Last week, we found out that the Consumer Price Index (CPI) rose 7.5% from a year earlier, the most since February 1982. And core inflation, which excludes the more volatile food and energy components, was up 6%, the highest since August 1982.

Most consumers would agree that high inflation is bad, as it erodes the purchasing power of every dollar earned. However, persistently high inflation can also have harmful effects on the stock market.

How so?

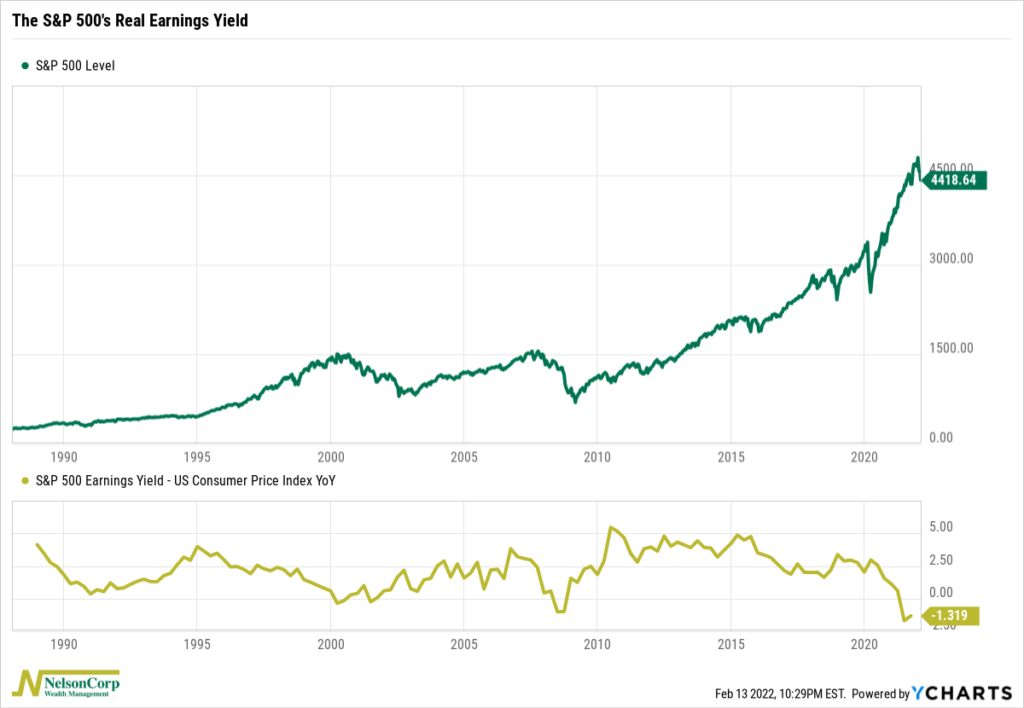

Take earnings, for example. To state the obvious, investors typically like companies with a lot of earnings. But inflation can erode the value of earnings, too. Since investors are only made better off investing their money in the stock of a company that is generating profits over and above the inflation rate, it makes sense to look at earnings after adjusting for inflation.

To do this, we first look at the earnings yield of the S&P 500 stock market index. The earnings yield is like the yield on a bond—except it uses the earnings per share of a company and divides that value by its stock price. The higher the earnings per share relative to the stock price, the higher the earnings yield and vice versa.

To adjust the earnings yield for inflation, we subtract the 12-month percent change in the Consumer Price Index to get the real earnings yield. Again, this is done because investors should only really care about gains over and above the inflation rate.

The gold line on the chart below shows what the real earnings yield has looked like over the past three decades.

As you can see, the current real earnings yield is deeply in negative territory. The important thing to note here is that nearly every time the real earnings yield has turned negative in the past, the stock market has suffered through a bear market. This is because it becomes a lot harder for investors to justify a high valuation multiple on stock earnings (a high P/E ratio) when inflation is eating away at the entire value of the earnings companies are generating.

The other problem with high inflation is that it tends to mean higher interest rates are right around the corner.

Since inflation is especially bad for fixed income assets—like bonds—investors tend to bid their prices down and their yields up to compensate for the loss of purchasing power due to inflation. At some point, bond yields become more attractive than stock earnings yields, so investors sell stocks and buy bonds. This concept was the theme of our Indicator Insights last week, and the main takeaway is that, historically, rising bond yields relative to stock earnings yields are bad for future stock returns.

So, to wrap up, although the revenues and earnings of companies might keep up with inflation this year, rising inflation also tends to weigh on valuation multiples via a lower real earnings yield. At some point, inflation can get so bad that it ultimately erodes the value of stock market earnings—and stock returns can suffer.

How much stock returns suffer will likely depend on how long this high bout of inflation lasts, as well as how far and how fast interest rates rise in response.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Inflation Blues first appeared on NelsonCorp.com.