OVERVIEW

U.S. stocks kicked off the new year on a positive note, with the S&P 500 climbing 1.4% last week. The Dow Jones Industrial Average rose 1.46%, and the Nasdaq Composite increased 0.98%.

Foreign markets had an even better start to the year. The MSCI EAFE Index of developed country stocks rose 2.67%, and the MSCI EM Index of developing country stocks surged 3.38%.

The bond market had a strong week as the yield on the 10-year Treasury yield dropped to 3.56%, down from 3.88% the week before. Intermediate-term Treasuries rallied 1.67%, and long-term Treasuries increased 4.86%. Investment-grade corporate bonds rose 2%, and high-yield (junk) bonds gained 2.23%.

Real assets were more mixed for the week. While real estate climbed 2.3%, commodities fell around 4.16%. Individually, oil dropped 7.5%, gold rose 2.38%, and corn fell 3.61%. And finally, the U.S. dollar rose about 0.32% to end the week.

KEY CONSIDERATIONS

Competition – Last year was rough for the stock market. But the good thing about a selloff is that it theoretically sets the market up for better future returns because valuations have come down.

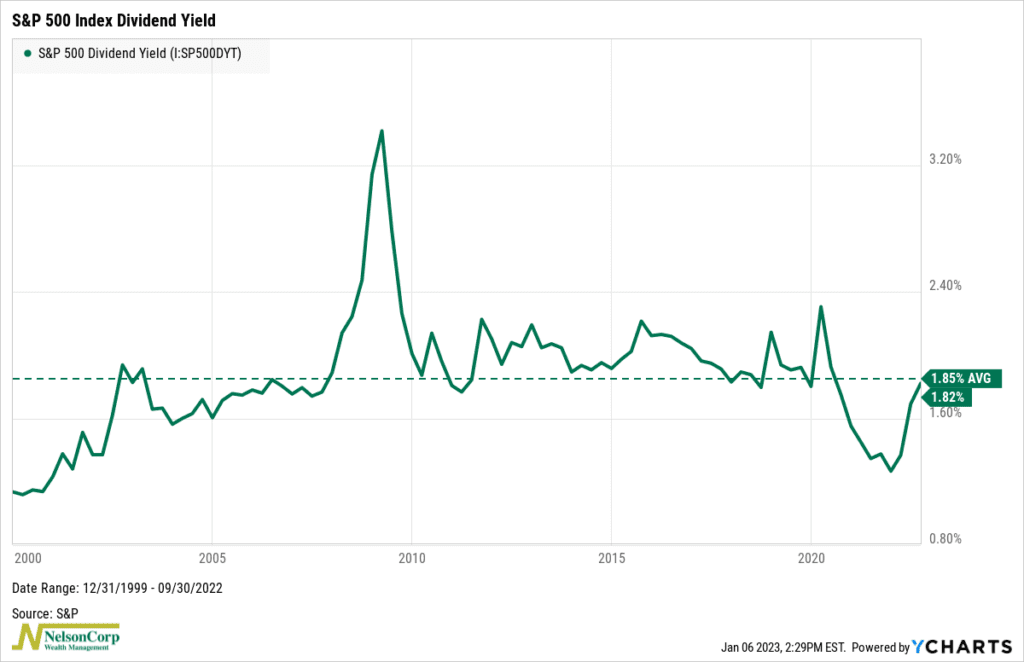

For example, the chart below shows that the S&P 500’s dividend yield has climbed back to its long-run average of roughly 1.85%. A year ago, it was just 1.27%.

This is good news. Basically, you don’t have to pay as much today for the stock market’s underlying cash flows as you did a year ago.

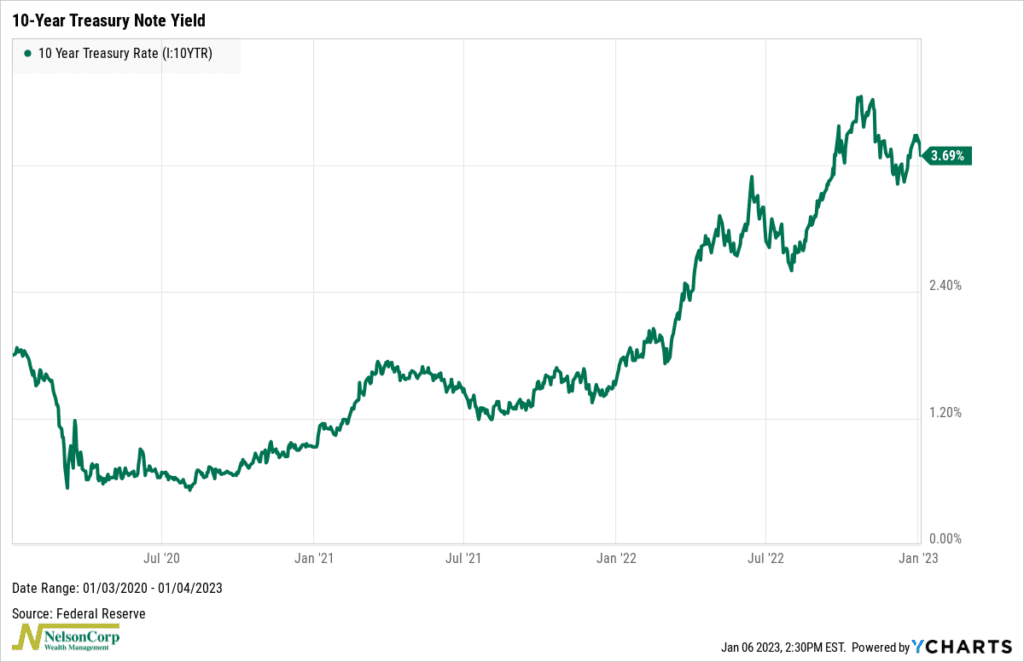

But there’s a problem. Here’s what the 10-year U.S. Treasury government bond yield has done over the past couple of years.

It has climbed from near zero to roughly 3.7% today.

So, we suddenly have a viable income-producing asset that can realistically compete with stocks for investor dollars.

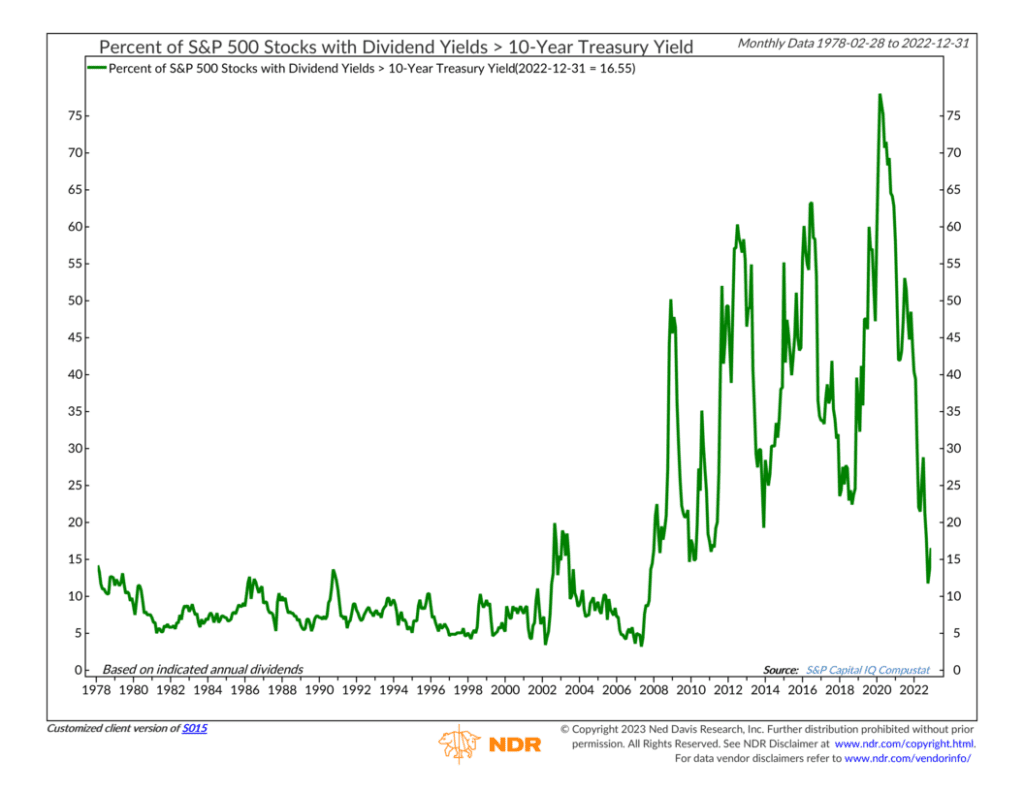

Here’s another chart that paints the picture nicely.

This one shows the percentage of S&P 500 stocks with a dividend yield greater than the 10-year Treasury yield. At roughly 15%, this is the lowest this measure has been in over a decade.

In other words, if you’re looking for income, you can get it from something different than stocks right now—and at rates we haven’t seen in a long time.

That means that if you’re looking to generate growth or capital gains from your stock investments, you must look at corporate earnings and valuations—and determine if the current environment where the Fed is aggressively hiking rates is conducive for growth.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Competition first appeared on NelsonCorp.com.