OVERVIEW

U.S. stocks dropped amid heightened volatility last week. The S&P 500 fell 0.53 percent, the Dow dropped 0.95 percent, and the Nasdaq declined 1.06 percent.

The sell-off was mostly centered around large U.S. stocks. Mid- to small-cap stocks, however, saw decent gains.

International stocks rose about a tenth of a percent in developed countries. Gains were even larger in emerging markets, around 1.10 percent.

The yield on the 10-year Treasury note rose nearly ten basis points for the week, and most bonds suffered price declines, particularly the ones with longer durations.

Commodities rose around half a percent, mostly due to continued gains in grain prices. However, crude oil prices ticked back below $40/barrel.

The U.S. dollar weakened against the world’s major currencies by about a percent, bringing its year-to-date loss to a range of around 3.5 percent.

KEY CONSIDERATIONS

Trouble With the Curve? – Longer-term interest rates have crept up steadily in the past few weeks. The yields on the benchmark 10-year and 30-year Treasuries rose to around 0.85 percent and 1.63 percent last week, their highest respective levels since early June.

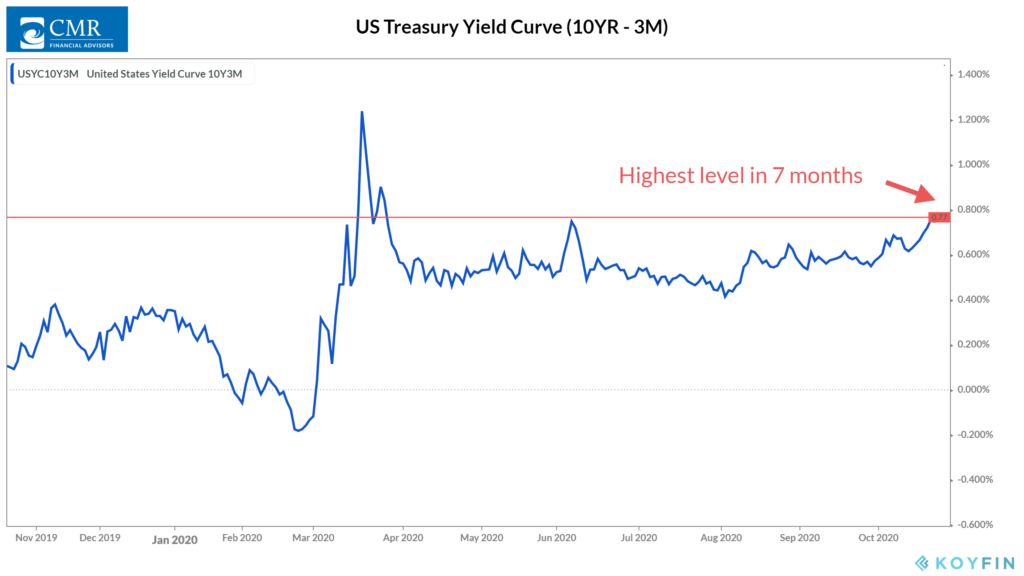

This moderate upward drift in longer-term Treasury yields has resulted in a widening of the so-called yield curve, which we measure here as the spread between the yield on the 10-year and 3-month U.S. Treasuries.

At around 77 basis points, this is the steepest yield curve reading since March. The theory on Wall Street is that the prospect for even higher fiscal spending and higher growth expectations could push long-term rates higher, resulting in a steeper yield curve.

How might this affect investments?

Well, it wouldn’t be good for bonds in the near term. Bond prices move in the opposite direction of interest rates, so if long-term rates move higher, it will hurt the market price of the current stock of bonds outstanding.

We find that a yield curve reading of 0.6 percent to 2.6 percent has historically been the best-case scenario for stocks to outperform relative to both bonds and cash. So if the yield curve can stay at current levels or even move moderately higher, the case for stocks to outperform bonds remains strong.

However, if we look at stocks all by themselves, we find that returns have historically been fairly weak during the period from when the yield curve first inverts (goes below zero) until it rises back above 3 percent. So it’s probably not unreasonable to be somewhat cautious at this time.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Trouble With the Curve? first appeared on NelsonCorp.com.