OVERVIEW

The U.S. stock market once again surged to record highs last week. The S&P 500 rose 1.52%, the Dow gained 0.96%, and the Nasdaq jumped 2.82%.

During the week, growth stocks had the upper hand, gaining about 2.3% versus the 1.74% gain for value stocks.

On the international front, emerging market stocks had a monster week, gaining 4.25%. Developed country stocks did well also, increasing about 1.83%.

The benchmark U.S. 10-year Treasury yield rose to 1.31% from about 1.26% the week before. Long-term Treasuries fell about 0.86% as a result of the higher yields. Investment-grade corporate bonds were flat on the week. However, high-yield bonds rose 0.7%, municipal bonds gained about 0.08%, and TIPS rose around 0.96%.

Real estate rose a moderate 0.38% for the week. Commodities, however, did exceptionally well, gaining about 5.69%. Oil was the biggest gainer, rising 10.87%, while gold rose 1.99% and corn gained 3.12%.

The U.S. dollar weakened by about 0.92% to end the week.

KEY CONSIDERATIONS

The Big Push – There’s a lot of information swirling around out there related to stocks and the stock market. So much so that it can be a bit overwhelming at times. But the good news is we have a way to cut through all the noise and get straight to the chase: look at the price.

By price, I mean the actual price movement of the stock market itself. Price, as the saying goes, is the sum of all information. So, if you hear conflicting information about what is going on in the stock market, you can often just look at the price action, and it will tell you what the consensus is. Prices might seem too high or too low, but the current price trend is what truly matters at the end of the day (most of the time).

For example, short-term sentiment among stock market participants recently reached their lowest (most pessimistic) levels since April of last year, when the market was still recovering from the pandemic-induced market selloff.

You would think that if investors are feeling down about stocks, returns would be weak. However, despite a lot of pessimism, the S&P 500 finished the week at a record high last week!

What’s going on here? Well, for one, our analysis shows that extreme levels of sentiment tend to be unstainable—and high levels of pessimism tend to be followed by good returns for stocks and vice versa.

However, another saying in the investing world is that there is nothing like price to change sentiment. In other words, sometimes the price action is just too good to pass up.

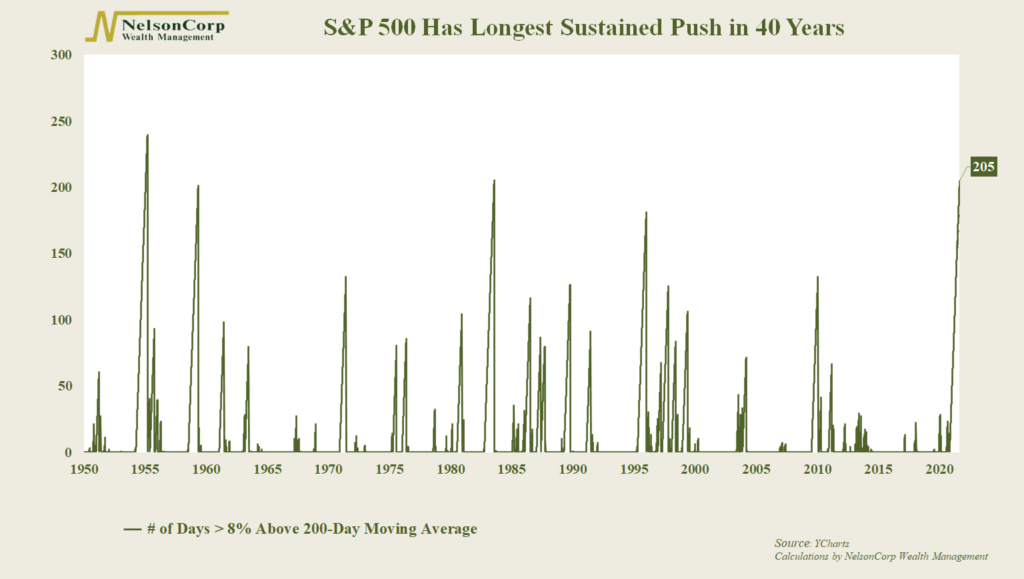

There may be some of that going on here. The chart below shows that the S&P 500 has traded more than 8% above its average 200-day price for 205 days in a row as of last Friday’s close. That’s the longest sustained “big push” in the market in the past 40 years.

And it’s showing no signs of slowing down. The S&P 500 is still trading more than 10% above its average 200-day price. The market is well on its way to one of its longest sustained uptrends in history.

And sure enough, short-term sentiment reversed last week and is heading back to more neutral levels. Again, there’s nothing quite like price to change sentiment.

To be sure, that’s not to say you should throw all the other external market factors out the door whenever prices are in a strong uptrend. We certainly don’t. But at the end of the day, if we can stay on the right side of a trending market, it helps ensure we’re able to sustain and compound wealth at the correct times—while also maintaining our risk exposure.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post The Big Push first appeared on NelsonCorp.com.