OVERVIEW

U.S. stocks surged to more new highs last week. The S&P 500 index rose 1.25%, the Dow Jones Industrial Average gained 0.44%, and the Nasdaq Composite increased 3.05%.

Foreign stocks also did well. Both developed and emerging market stocks rose over 1.5%.

Interest rates picked up last week. The 10-year Treasury note yield rose to 0.95%, resulting in losses for intermediate- to long-term Treasuries. Corporate bonds saw moderate losses, as well.

As for commodities, gold gained around 2.3%, oil rose nearly 5%, and corn gained about 3.3%.

Real estate had a good week, too, gaining about 0.7%.

And finally, the U.S. dollar fell over 1% to end the week.

KEY CONSIDERATIONS

Risks in the Year Ahead – 2021 is right around the corner, which means we are about to enter the second calendar year of the cyclical bull market that began when the market bottomed in March.

What can we expect in the new year?

Well, we can’t know for sure. But our investment philosophy calls for managing and measuring risk, so we like to keep our eye out for potential threats that could upset this bull market.

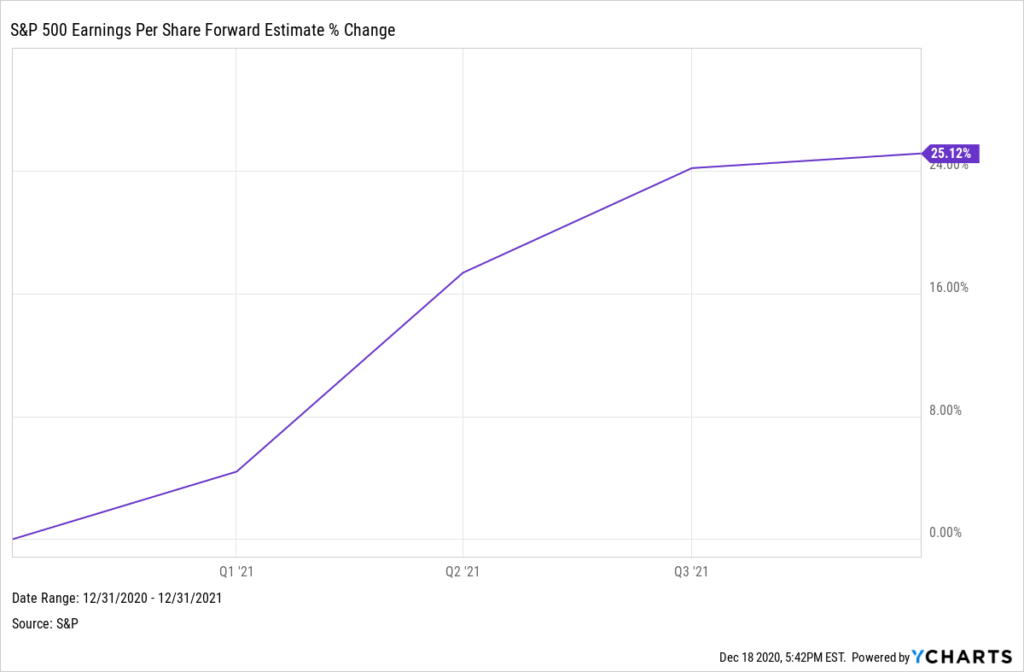

The good news is that the economic environment looks good for stocks; therefore, the consensus for what companies are expected to earn in 2021 is quite strong. Forward estimates for S&P 500 earnings per share are expected to grow by 25.12 percent next year.

However, the bad news is that in the second year of a cyclical bull market, earnings growth increases rapidly, but prices don’t grow as fast as they did in the first year, leading to what is called multiple compression. Said differently, although earnings will be rising, prices won’t necessarily keep up because all that growth got priced in this year.

We also find that cyclical bull markets that come after a recession (like this year) tend to be strong but brief. The median post-recession bull market has lasted around 15.6 months, which would put the current bull market into the third quarter of next year.

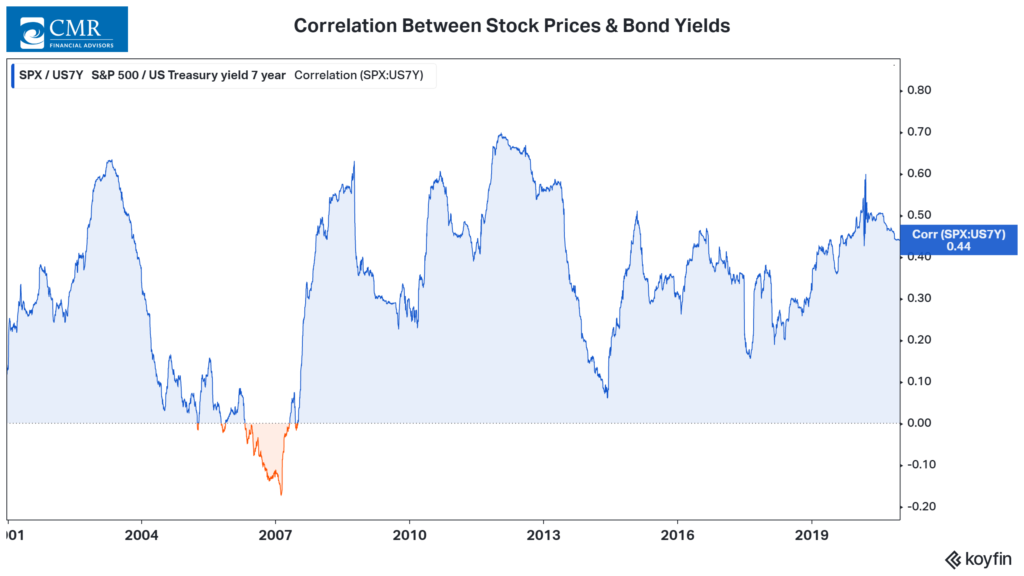

On a different note, if the recent rise in bond yields continues to be seen as a positive sign for the economy, then the correlation between stock prices and bond yields will remain positive. In other words, as bond prices fall and yields rise, stock prices will tend to increase as well.

The best-case scenario is a “goldilocks” situation, in which the economic recovery is neither too hot nor too cold.

However, if, for example, inflationary pressures get out of hand, the correlation between stock prices and bond yields could break down, leading to falling stock and bond prices.

The key takeaway is that, despite a global pandemic and recession, the stock market saw a pretty nice expansion in prices relative to earnings this year. This trend may continue into next year. But the risks outlined above don’t give the market a whole lot of room for error.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Risks in the Year Ahead first appeared on NelsonCorp.com.