OVERVIEW

Overall, it was a mixed week for financial markets to close the year.

In the U.S., the S&P 500 saw a decline of 0.14%, the Dow Jones Industrial Average dropped 0.17%, and the Nasdaq Composite registered a loss of 0.30%.

The VIX Index, which measures market volatility, increased by 3.83% to 21.67.

Looking at foreign markets, the MSCI EAFE Index and MSCI EM Index both saw slight gains of 0.02% and 0.17%, respectively.

The 10-Year Treasury yield settled at 3.88%, up from 3.75% the previous week. Intermediate-term Treasuries saw a decline of 0.56%, while investment-grade corporate and high-yield (junk) bonds saw losses of 0.72% and 0.93%, respectively. TIPS, or Treasury Inflation-Protected Securities, also saw a decline of 0.46%.

Real estate dropped 0.31%. Commodities, however, had a positive week, with a 0.22% increase in the overall market and individual gains in oil (1.14%), gold (1.22%), and corn (1.84%). The U.S. Dollar realized a decline of 0.61%.

KEY CONSIDERATIONS

Element of Surprise – There are times when the economy and financial markets are relatively stable and more predictable.

Other times, however, the economy is in a state of change or turmoil, making it harder to predict and causing asset prices to be more volatile.

This has been particularly evident in recent years, as analysts have struggled to forecast economic data accurately.

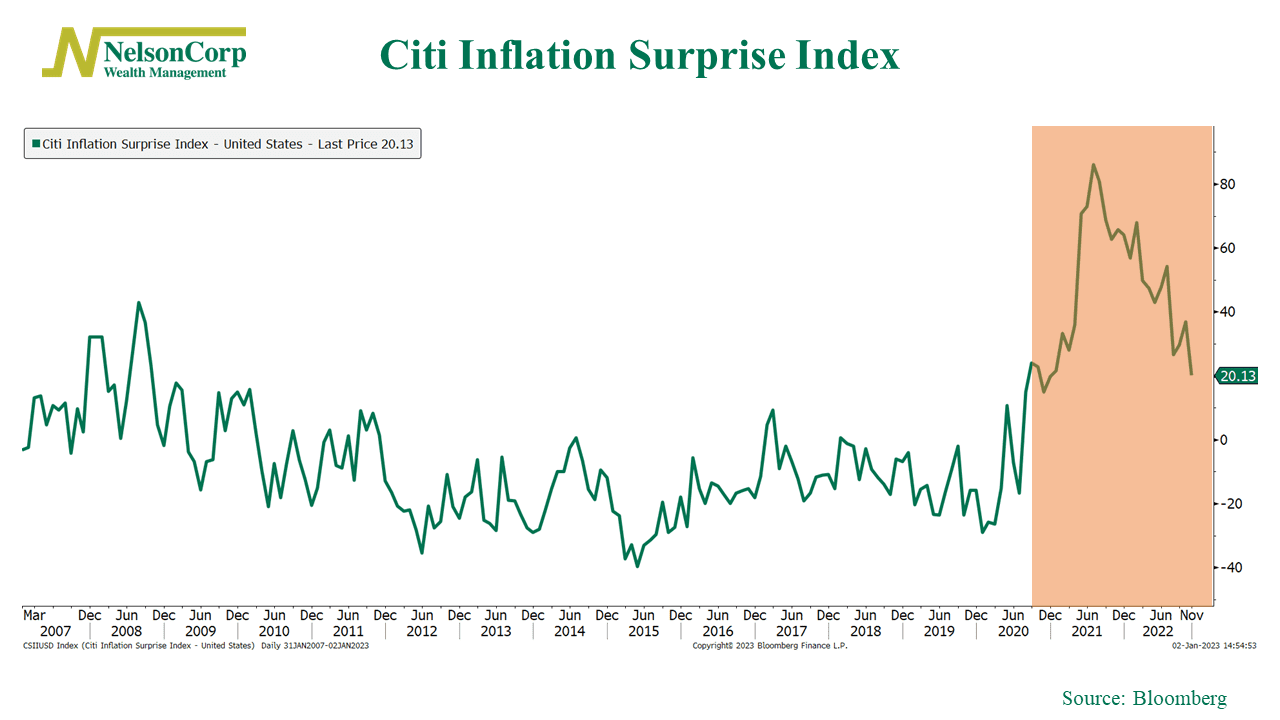

One way to objectively assess this is through the use of a “surprise index,” which measures how much an economic indicator deviates from analysts’ expectations.

For example, the Citi Inflation Surprise Index, which tracks consumer and producer price inflation and wage surprises since 1997, reached a record high in mid-2021 and has remained elevated in 2022.

The good news? The series is trending downwards, a sign that inflation has likely peaked in the United States.

A drop in inflation surprises should help settle down volatility in financial asset prices.

The bad news, however, is that investors are concerned about the speed at which inflation will fall.

Historically, it has taken an average of over three years for U.S. inflation to return to below 2% after reaching above 8%.

The bottom line? The rate at which inflation returns to normal levels will significantly impact asset prices in 2023.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Element of Surprise first appeared on NelsonCorp.com.