OVERVIEW

U.S. stocks fell last week, with the S&P 500 declining by 3.4%. The index is now up 5.4% from its October 12 closing low of 3,577.03 and down 21.3% from its January 3 closing high of 4,796.56.

The Dow Jones Industrial Average did relatively better, locking in a weekly decline of 1.4%. And the Nasdaq Composite brought up the rear, falling 5.7%—its worst week since Jan. 21st.

Foreign stocks, on the other hand, saw positive gains for the week. The MSCI EAFE index of developed country stocks rose 1.2%, and the MSCI EM index of emerging market stocks surged 4.7%.

Treasury bond prices fell as the yield on the 10-year Treasury note rose about 15 basis points to end the week at 4.16%. Investment-grade corporate bonds declined about 0.6%, and high-yield bonds dropped 1.2%. TIPS were also down around 1.1%. Municipal bonds, however, gained about 7 basis points to end the week.

Commodities had a strong showing, with the Bloomberg Commodity Index popping 5.1% for the week. Oil led the rally with a 5.5% weekly gain, followed by gold’s gain of 1.9% and corn’s slight increase of about 4 basis points. The U.S. dollar ended the week moderately higher, to the tune of about 0.17%.

KEY CONSIDERATIONS

Cumulative Tightening–But Not Yet! – Last week’s biggest piece of market-moving news was the Fed’s FOMC meeting.

As expected, the Fed went ahead and hiked the Fed Funds rate by another 0.75%; no real news there.

In the Fed’s prepared statement, however, they inserted some new language about taking into account the cumulative effects of rate hikes and monetary policy lags. In other words, the Fed would be looking at the sum of their actions up to this point, and they would also be mindful of the lags with which their rate hikes affect the economy.

This vibes well with our featured indicator of the week.

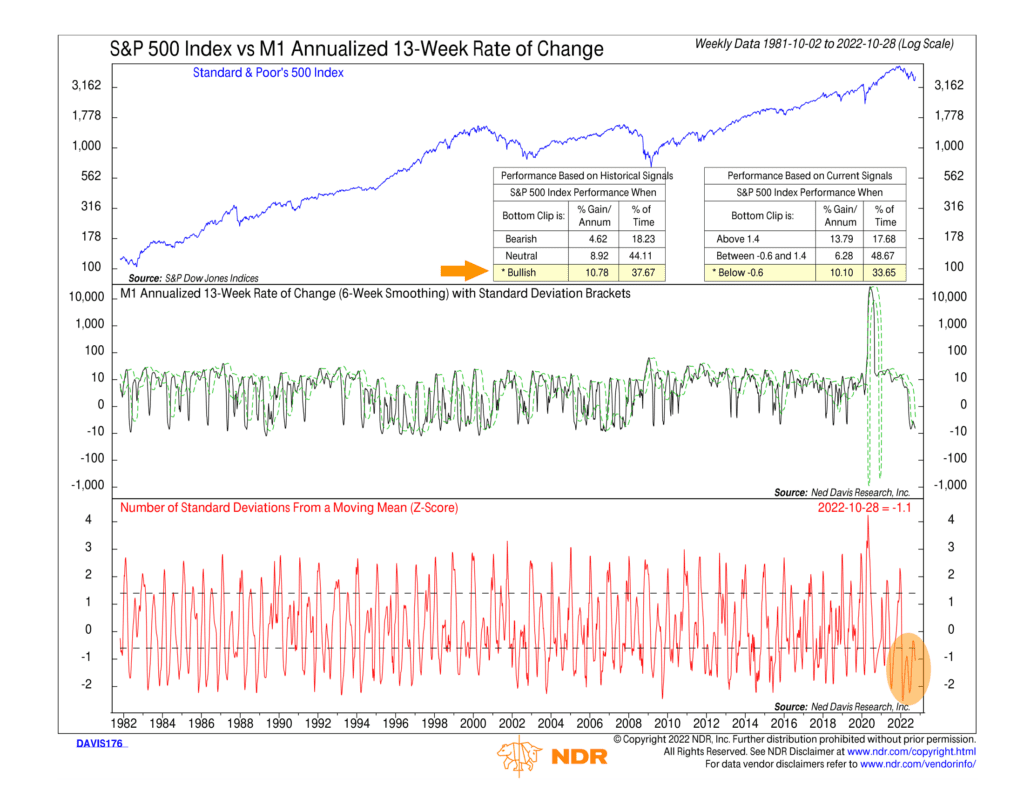

The indicator, highlighted below, shows that the M1 money supply growth rate has slowed significantly this year.

This is a good representation of what the Fed means when it says “cumulative effects of tightening.” Draining liquidity from the system should, in theory, put downward pressure on inflation, which, according to the historical record, would be a bullish condition for stocks.

And indeed, the stock market rallied when the Fed’s statement was first released.

But then Fed Chair Jerome Powell spoke, and he said this:

“It is very premature, in my view, to think about or be talking about pausing our rate hikes.”

Thud! Another head fake. The S&P 500 Index responded by dropping 2.5% and continued its descent into Thursday.

The problem, as Powell made clear, was that the terminal rate for the Fed Funds rate may still be higher than previously expected.

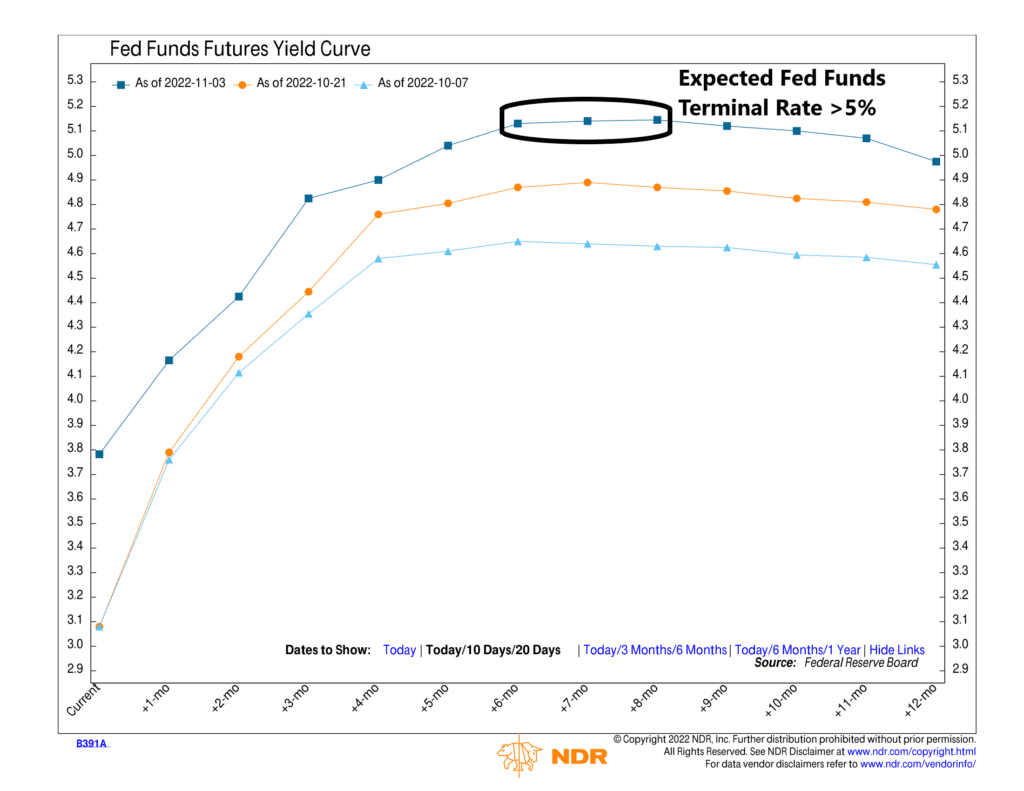

The chart below illustrates this nicely. It shows where the market expects the Fed Funds rate to be over the next 12 months, with each line representing a different snapshot in time.

The light blue line was 20 days ago, the orange line was 10 days ago, and the dark blue line is today. As you can see, each successive line has moved higher, meaning the terminal rate has moved higher. Currently, the market expects the peak to be above 5% sometime next summer.

The takeaway? My gut says that we need to see the fed futures curve stop bumping higher before we see any real stabilization in the stock market.

So, to wrap up, the bottom line is that we were left with two main messages from the Fed’s meeting last week: That the Fed will indeed be taking into account the cumulative effects of their hikes so far, but, at the same time, the endpoint is likely higher than it was, given how inflation data continue to come in hot.

In other words, the Fed won’t tell us they’re done until they know they’re done. And until that uncertainty is resolved, it remains a challenging environment for the stock market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Cumulative Tightening–But Not Yet! first appeared on NelsonCorp.com.