OVERVIEW

U.S. stocks broke a three-week losing streak last week as volatility—as measured by the VIX Index—fell nearly 15%. The S&P 500 climbed 1.75%, the Dow gained 1.9%, and the Nasdaq surged 2.58%.

Foreign markets delivered solid performances as well. The MSCI EAFE Index of developed country stocks increased 1.74%, and the MSCI EM Index of emerging market stocks climbed 1.66%.

Over in the bond market, the benchmark U.S. 10-year Treasury rate rose throughout the week before ultimately dropping on Friday and ending the week lower than where it started. This resulted in broad-based gains for bonds overall. Long-term Treasuries rose 1.13%, and corporate investment-grade bonds increased 0.42%. High-yield (junk) bonds gained about 0.8%, and TIPS increased 1.36%.

Real assets performed strongly, too, last week. Real estate gained 1.42%, and commodities rose 2.62% broadly. Oil led the way, rallying 4.11%, and gold rose 2.06%. The only assets to register negative returns for the week was corn, down 1.46%, and the U.S. dollar, down 0.63%.

KEY CONSIDERATIONS

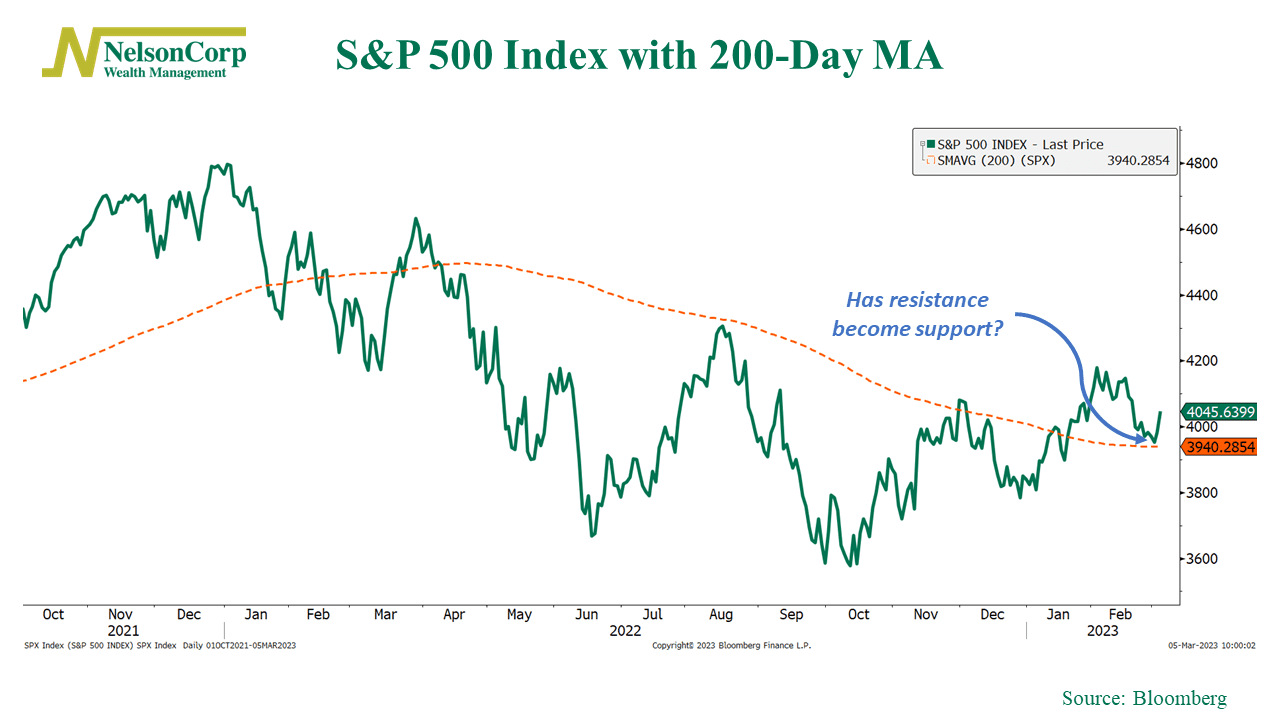

Catching a Bid – The stock market finally caught a bid (moved higher) last week after three straight weeks of declines. From a technical perspective, the good news is that the S&P 500 Index bounced when it reached its 200-day average price, shown below.

This is a key technical level that we’ve talked about many times before. To see the market aggressively bounce when tested like this is a very encouraging sign—particularly since the 200-day moving average was a source of resistance all of last year.

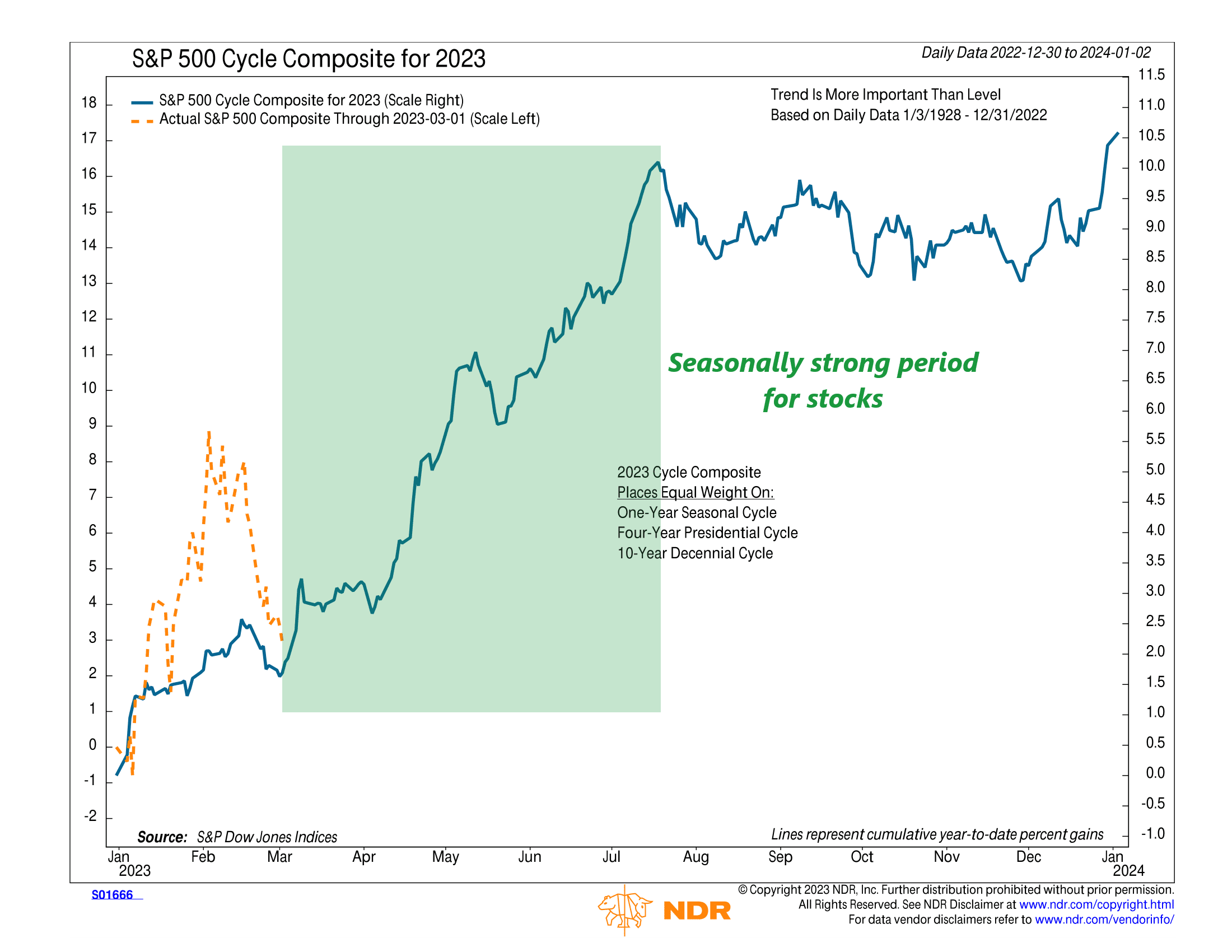

Another source of optimism has to do with the fact that we are about to enter a seasonally strong period for the stock market. As we pointed out in our Chart of the Week blog post last week, the five months from March to July tend to be a particularly bullish period for the S&P 500—as highlighted on the Cycle Composite chart below.

We like to think of this as the base-case scenario for the stock market in 2023. Things could play out differently, but this is likely the path of least resistance.

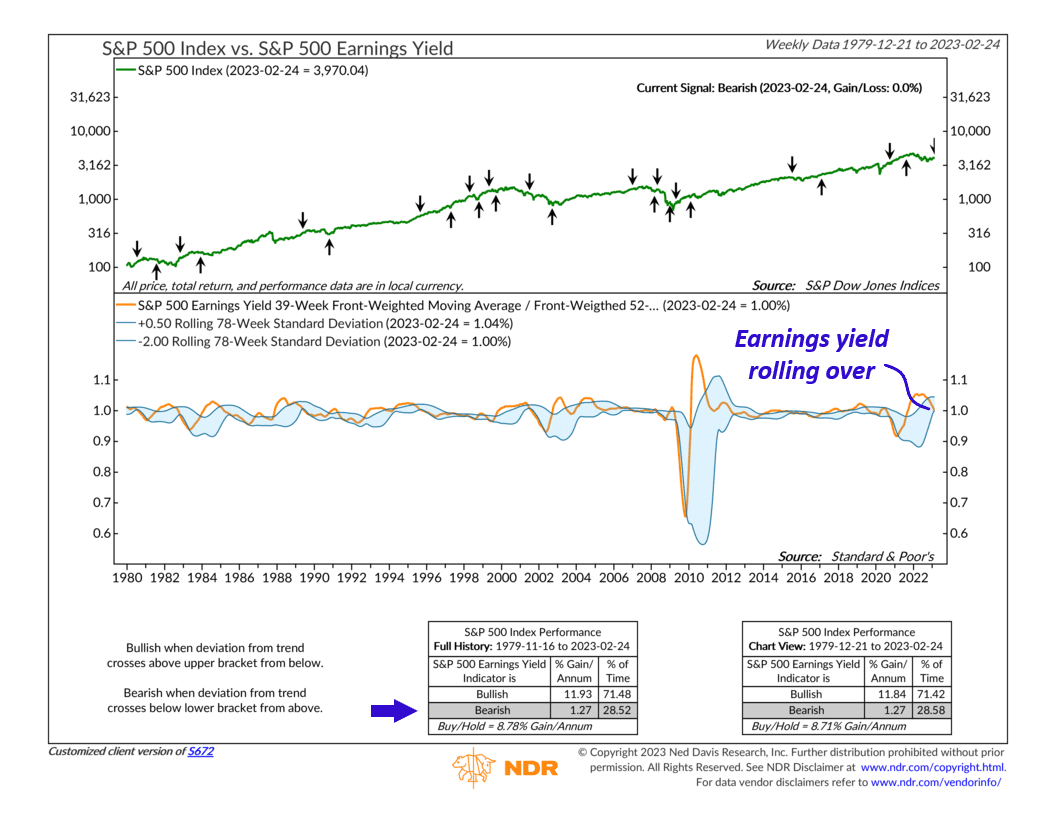

But, of course, things are always changing in the financial world, and historical tendencies don’t always match perfectly with reality. One concerning thing about the current environment is that earnings are starting to fall off trend. For example, the chart below shows the 39-week front-weighted moving average of the S&P 500 earnings yield divided by its 52-week front-weighted moving average. That’s a mouthful, but basically, this is a way to conceptualize how earnings as a percentage of stock prices are trending over time.

As shown on the chart, the S&P 500 earnings yield—as measured this way—has rolled over and triggered a bearish signal. Historically, this has been a poor environment for stock market returns. And the bottom line is that stock earnings don’t look very attractive at current price levels.

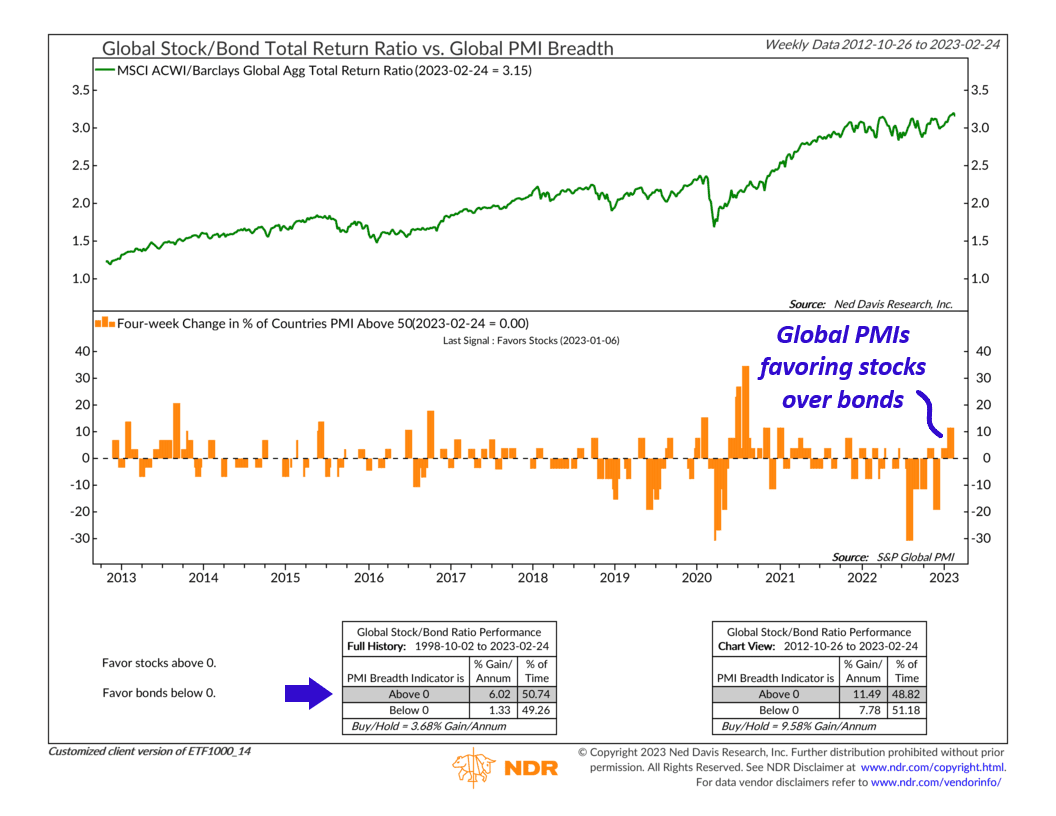

On the other hand, the economy is holding up decently overall. Although leading indicators point to weak economic growth, we have—so far—avoided a deep dip in economic activity. One way to view this is via the chart below, which shows the four-week change in the percentage of countries whose PMI—a measure of economic activity—is above 50.

It rose into positive territory to start the year and then increased even further in February to nearly 12%—its highest level since 2020. From a global perspective, this suggests that the current environment favors owning stocks over bonds.

To wrap up, then, we’d say that the weight of the evidence is still mostly neutral at this time. Things are starting to improve from a technical perspective, global economic activity favors stocks over bonds, and seasonally we are entering a bullish period for stocks. But corporate earnings still leave much to be desired. And based on current prices, the stock market overall still appears to lean on the expensive side.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Catching a Bid first appeared on NelsonCorp.com.