OVERVIEW

U.S. stocks took a step backward last week as the number of new COVID-19 cases started rising at a quicker pace in many states throughout the country.

The S&P 500 index fell 2.86 percent, and the Nasdaq Composite fell 1.9 percent.

All of the S&P 500 sectors declined, but the energy sector was hit the hardest, falling over seven percent. The ever-dominate technology sector, however, lost just 0.68 percent for the week.

Globally, developed country stocks outpaced the U.S. stock market by roughly 1.5 percent. Emerging market stocks did even better, however, falling just a quarter of a percent.

The 10-year Treasury yield dipped to 0.647 percent by Friday’s close, its lowest in over a month.

High yield bonds declined by 1.15 percent, while investment-grade bonds were mostly flat for the week.

Gold prices rose about 1.56 percent, but declines in oil and grain prices dragged the broad-based commodity index lower.

KEY CONSIDERATIONS

Brother, Can You Spare a Dime? – One of the major themes of 2020 has been the Federal Reserve and its remarkable response to the pandemic-induced economic crisis. The steps taken — and the speed at which they were made — has been nothing short of extraordinary.

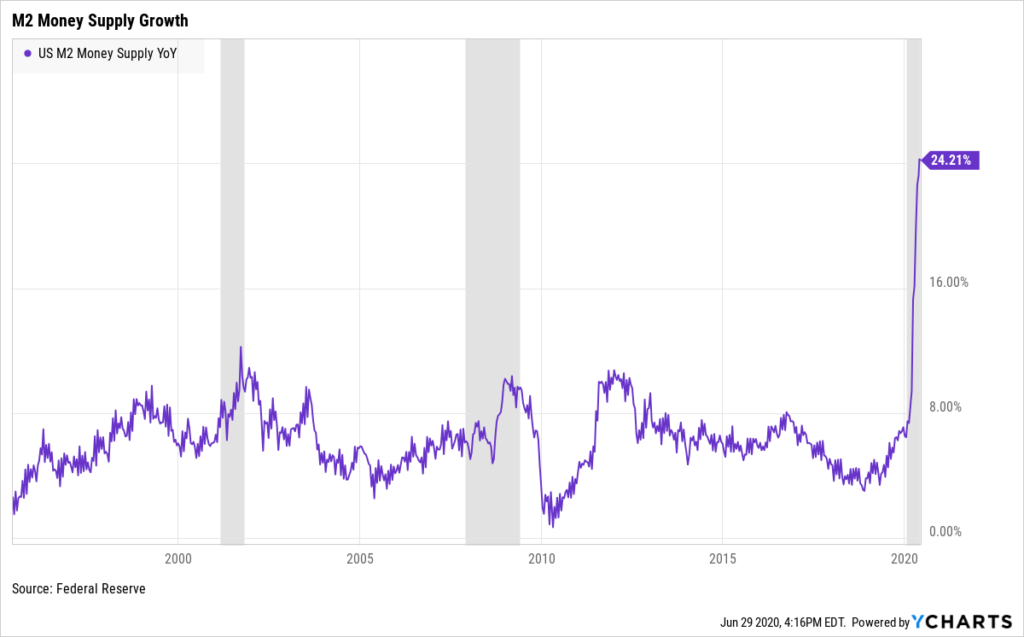

I won’t bore you with the alphabet soup of lending facilities launched by the Fed this year, but the chart below sums up just how unparalleled the response has been. The M2 money supply, a broad-based measure of the amount of money in circulation, has skyrocketed to over 24 percent on a year-over-year basis.

In the prior recessions of the past two decades, this measure of the money supply never jumped much over ten percent!

Of course, substantial increases in the money supply are always accompanied by fears of impending inflation. In the past few decades, however, these fears turned out to be overblown.

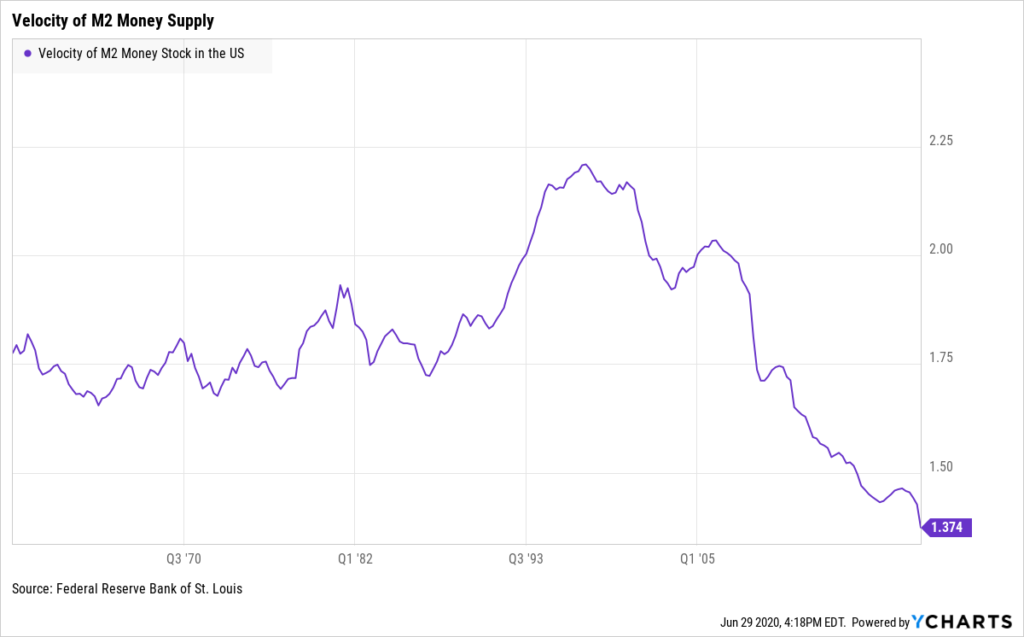

The velocity of money, or the rate at which money is exchanged, has fallen steadily for many years now — and inflation has stayed muted.

More so, with interest rates near zero, the economy fell into what is known as a liquidity trap during the Great Recession of 2008, and even huge increases in the money supply failed to be inflationary.

Maybe this time is different. Or perhaps we will just see asset price inflation, which partly explains why the stock market has done well recently. But whatever the case, neither the economy nor the stock market will be left wanting for money this go around.

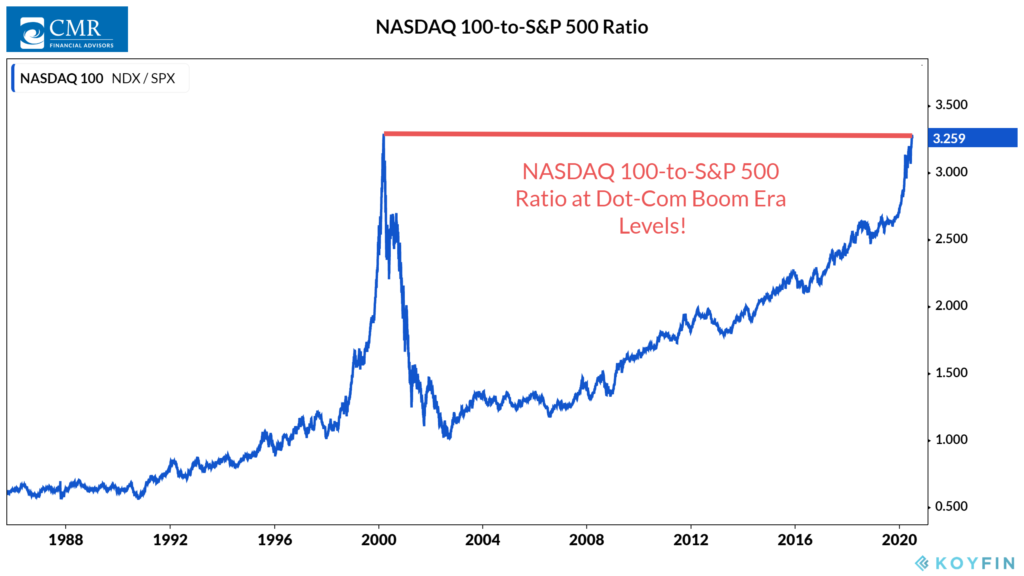

Party Like It’s 1999 – Another major theme of the past decade is the dominance of the big tech names relative to the rest of the stock market. And recently, this has accelerated immensely.

In fact, the ratio of the NASDAQ 100 index to the S&P 500 index has reached the high point set during the dot-com boom 20 years ago!

A first reaction is that this is doomed to end badly. Perhaps it will. But at second glance, the major tech names today are vastly more profitable (or just actually profitable) than the internet companies being speculated on during the dot-com boom.

It’s been noted that new technologies tend to take some time before their potential is fully realized. It happened with computers, and then again with the internet. And now, we are seeing the world transition even more rapidly (thanks to the pandemic) to the new era of cloud computing, artificial intelligence, e-commerce, etc. It makes some sense, then, that the stocks tied to these industries are doing so well.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The post Brother, Can You Spare a Dime? first appeared on NelsonCorp.com.